Is Aswath Damodaran Right On Mechanical Investing?

If you’re finding it difficult to run a successful mechanical investment strategy, you’re not alone. Professor Aswath Damodaran is, as well.

Over the last decade or so, it’s become common knowledge that active portfolio managers fail to beat the market. But, over the previous few years, it’s come to light just how painful the experience has been for ordinary retail value investors.

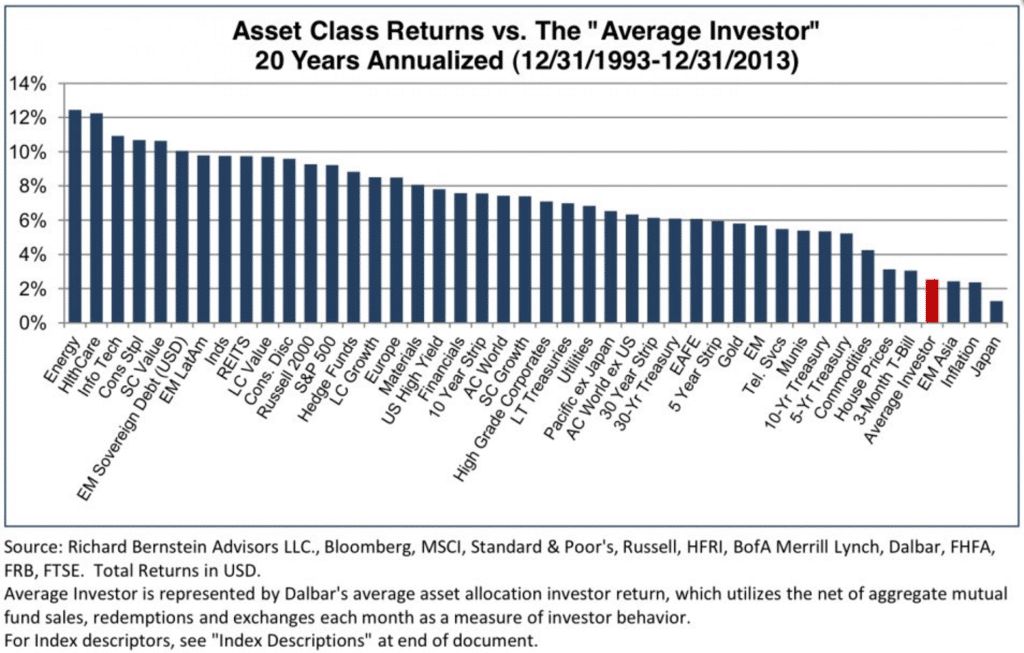

Rather than outperform large fund managers, from 1993 to 2013 small individual investors performed so badly that they would have been far better off in a coma-inducing portfolio made up of 3 month T-Bills.

Given the number of strategies out there that purport to beat the market each year, you would expect well-informed value investors to do better. While it’s not realistic to expect that every individual investor has put his money into mechanical value investing strategy, there are a few reasons why a small mechanical investor could be underperforming the market.

Recently I came across an interesting article by Aswath Damodaran, titled “Transaction Costs and Beating the Market,” that attempts to address at least some of the reasons for the failure of the little guy to match the projected returns of a wide range of mechanical strategies, never mind beat the pros.

Who Is Aswath Damodaran?

Aswath Damodaran is a finance professor at the Stern School of Business at New York University. Originally from India, Professor Damodaran now focuses on teaching millennials interested in making money in stocks all about corporate finance and equity valuation.

He's good at it, too. Since the early 1990s, he's penned no less than 20 books on the topic, the most widely known being "The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit". If the phrase "the little book of..." rings familiar to you, it's with good reason. The "Little Book of" series has become very popular with retail investors and includes authors such as Jack Bogle, Chris Brown of Tweedy, Browne, and Joel Greenblatt. Not content to publish some pretty great books, he also has a popular website on investing, "Musings on Markets".

Professor Aswath Damodaran On Why Mechanical Investing Strategies Fail

But, there's a difference between having great credentials and being correct on a specific aspect of investing. In this case, Professor Damodaran claims that it's far harder than it seems to squeeze solid profits out of mechanical strategies.

“How is it that there seem to be so many ways to beat the market on paper but that so few money managers seem to do it in practice? A key reason, in my view, is that transactions costs have a much greater impact on returns than we realize.”

A lot of investors underestimate the impact that transaction costs have on a mechanical investment strategy. In this case, Professor Damodaran is specifically talking about the cost of trading small illiquid stocks. He continues,

“The biggest culprit, in my view, is transactions costs, defined to include not only the commission and brokerage costs but two more significant costs - the spread between the bid price and the ask price and the price impact you have when you trade. The strategies that seem to do best on paper also expose you the most to these costs.”

Many investors don’t realize that there are three prices when it comes to buying or selling a stock: the ask price, the bid price, and the market price. The bid price refers to the price that your broker tries to buy the stock at. On the trading floor in the old days, or in the computer programs of modern markets, a floor trader would make an offer on a block of stock that he hoped to buy for a client. This price is known as the bid price. Conversely, when a broker or trader tries to sell a stock for a client he’ll list a price that he’s willing to sell at, known as the ask price. Eventually, two floor traders would agree on a price, and we call this the market price.

According to Professor Aswath Damodaran, the gap between the bid and ask price can be enormous.

“Consider one simple example: Stocks that have lost the most of the previous year seem to generate much better returns over the following five years than stocks that have done the best. ……..Later analysis showed, though, that almost all of the excess returns from this strategy come from stocks that have dropped to below a dollar (the biggest losing stocks are often susceptible to this problem). The bid-ask spread on these stocks, as a percentage of the stock price, is huge (20-25%)…”

…and Professor Aswath Damodaran cites this bid-ask spread as being responsible for eroding much of the stock returns that mechanical strategies claim to be able to produce. But, that’s not the only problem with buying tiny illiquid value stocks. He continues…

“…and the illiquidity can also cause large price changes on trading - you push the price up as you buy and the price down as you sell. Removing these stocks from your portfolio eliminated almost all of the excess returns.”

In my own experience as a net net stock investor, almost all of the best quality net net stocks have tiny share prices, often below $1, and are very illiquid. They’re also often listed with bid-ask spreads at least as large as Professor Aswath Damodaran mentions. Yet, despite this, my own portfolio has performed exceptionally well. Maybe there’s more to it than just liquidity and bid-ask spreads.

Why These Issues May Not Trip You Up

One complicating factor is portfolio size. Professor Damodaran’s article makes it seem like all investors are subject to these limiting factors to the same degree — or at least he doesn’t suggest that any one group can be more or less effected. In the trenches of everyday investing, small retail investors, folks like you or me, are subject to these barriers to a much smaller degree.

In fact, when buying and selling stocks for a portfolio under $100 000USD, illiquidity and bid-ask spreads are almost never a barrier to outstanding returns. To deal with these issues, small investors can use limit orders and wait to obtain their position. This is not a theoretical argument — our own Net Net Hunter members do this each and every day with great success.

Admittedly, things become a little more complicated when your portfolio approaches $1 Million in market cap, and next to impossible if you’re managing over, say, $20 Million. At a certain point, issues of liquidity and bid-ask spreads become real problems that prevent investors from using a mechanical strategy. But, it’s a mistake to think that every investor is subject to these barriers to the same degree. Most retail investors aren’t.

The same goes for the impact trading has on the price of a stock. If you’re not buying that much of a security, or if you’re using limit orders and waiting patiently, filling an order for a stock at the market-listed price, on Google Finance for example, is not an issue.

So what is?

The Real-World Impact of Illiquid Stocks On Mechanical Value Investing Strategies

Professor Aswath Damodaran’s focus on transaction costs is not completely irrelevant for investors with tiny portfolios. Actually, transaction costs in the form of taxes and broker costs do have an impact on your portfolio returns.

Every country has their own unique tax laws when it comes to capital gains, but you should be trying to minimize your tax burden by using retirement accounts and other legal structures open to you when advantageous. Not all investment accounts allow investors to buy stocks that fit specific investment strategies though, so individuals have to weigh the costs and benefits of using a high return taxable strategy with saving on taxes if the strategy they choose to employ won’t work in a retirement account.

And, I do mean that you should weigh the costs and benefits of doing so. Often investors focus on controlling, or minimizing, the cost of investing despite the much higher returns they could earn. Imagine giving up on a strategy shown to return a CAGR over 20% on average to save 1.5% in transaction costs? This sort of lunacy happens more than you’d guess. Ultimately, as small investors saving for retirement, we should be after the highest after tax returns while taking on only a small amount of risk.

Luckily, the internet has steadily worked to eliminate the other barrier to realizing the returns promised by mechanical strategies. Brokerage fees have been steadily falling over the past two decades and the costs associated with trading are now fairly insignificant. Here, it’s up to you to assess the limitations of sticking with your existing broker in favour of moving to another low cost service provider. As one of our members put it:

“Yikes....... I took a look exactly how much I paid in commissions, and compared it to the rates Interactive Brokers has listed on its site……. Interactive Brokers seems to be charging so little for its trades, that I would have been far better off with them.”

There are more options than Interactive Brokers if you’re running an international portfolio, of course. Here are 5 more international brokers to look at.

The Biggest Hurdle To Your Mechanical Value Investing Success

But, In my experience, the biggest barrier that small individual investors have when it comes to realizing the returns offered up by mechanical investment strategies is taking their eye off the ball.

Discipline accounts for the largest barrier to successful investing. Lack of discipline often shows up in inconsistent focus on implementing their chosen strategy.

I see it constantly. A new investor will charge full force into a net net stock strategy with every intent on putting together a solid portfolio and executing the strategy over the long term… but then life takes over. Work gets busy, family issues surface, or a number of other things come up to derail the project. In other cases, while the returns on offer haven’t changed, that initial enthusiasm fades and the investor moves on to a new style of investing. This is a recipe for mediocrity no matter what strategy you choose.

Another issue is the effect that investment mistakes have on your portfolio return. Investors under-appreciate just how easy it is to make basic investment mistakes, even running a mechanical investment portfolio, and the impact those mistakes have on their portfolio.

Take making a basic error when it comes to selecting fitting stocks for your portfolio, for example. When it comes to mechanical investing, the idea is to fill your portfolio with stocks that meet only a few basic criteria: low price relative to some source of value, low levels of debt, etc. If an investor slips up and accidentally includes stocks that don’t actually fit the strategy, his portfolio is not firing on all cylinders. With the reliance on standardized financials rather than going back to the actual company filings, this happens more than you’d think.

Investors who fail to acquire basic knowledge needed to use the strategy often suffer from this investment error, as well. Mechanical strategies are simple, but that simplicity often causes investors to sidestep digging deeper into the strategy to see how it ticks, developing their accounting background, or even failing to learn how they should approach major market movements.

Abandoning a strategy when market conditions look dangerous or when the strategy has underperformed the market over the past couple years is another major mistake. Individual investors believe they can, or that pundits can, predict market movements even when compelling evidence shows that that isn’t the case; and, as much as I’d like it to be otherwise, no mechanical investing strategy beats the market each year.

These basic errors can have such a large impact on your portfolio that they can completely wipeout any advantage gained by following a mechanical value investing strategy. This is why it’s a good idea to use investment strategies that have been shown to beat the market again and again, over a long period of time, by the widest margin. At least that way when you inevitably do make investment mistakes you have a large enough buffer between the market return and the return associated with your investment strategy to soak up any goofs.

It’s really unfortunate that small investors have had such a tough time in the market but I wouldn’t blame their poor performance on illiquidity and bid-ask spreads, as Professor Aswath Damodaran does. There are very real issues that you, as a small retail investor, face that need to be addressed if you’re to invest successfully. I’ve listed a few of them here but there are definitely more.

If you’re a small investor who’s trying to use a mechanical investment strategy successfully, consider a strategy that’s been shown to produce the highest possible returns over a long period of time, such as Graham’s net net stocks. That way, even when you do make basic investment mistakes, the strength of the strategy will still help you achieve good results.

Start putting together your high quality, high potential, net net stock strategy. Click Here to to get a free net net stock checklist.