What You’re Getting

Net Net Hunter is the only members site 100% dedicated to classic net net stock investing. Check out everything we offer below.

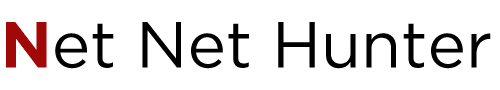

Shortlists of High Potential Net Net Stocks

Get quick access to high potential net net stocks – many poised to double within a year.

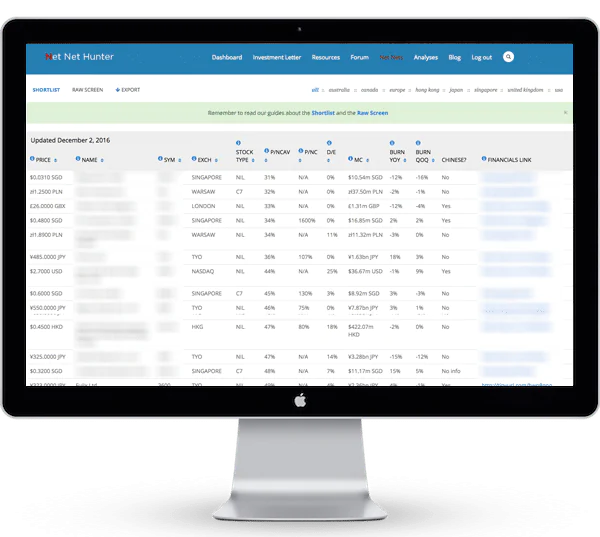

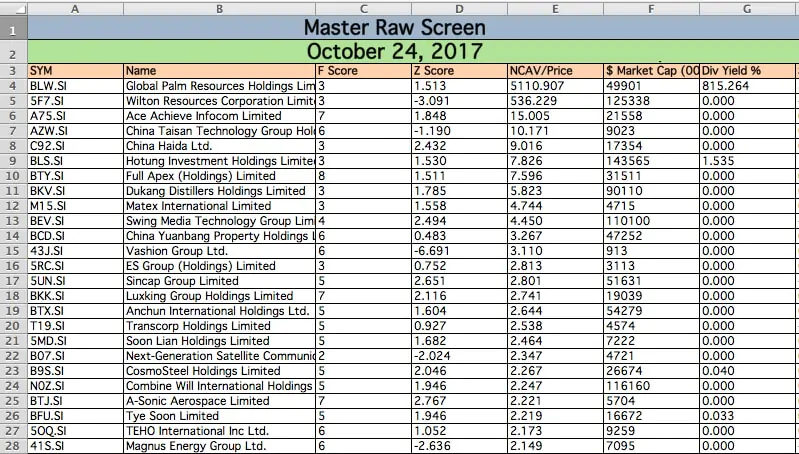

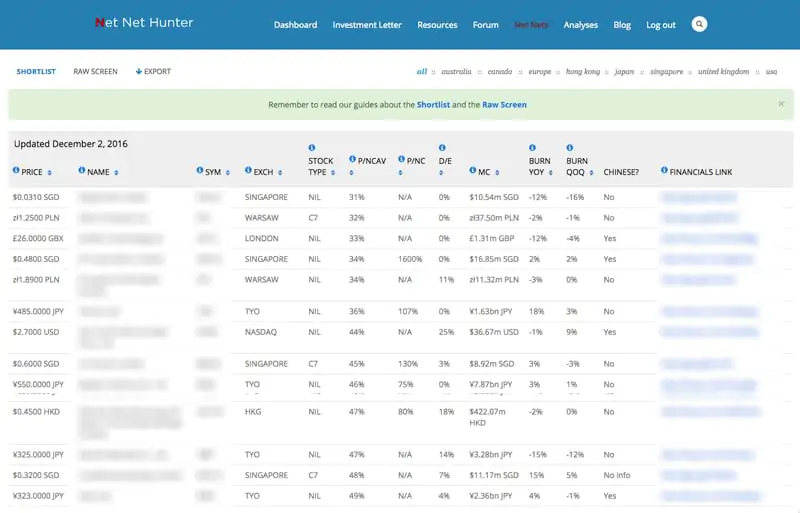

International Raw Screens

Browse over 1000 net net stocks from the USA, the UK, Continental Europe, Canada, Australia, Singapore, Hong Kong and Japan (28 countries total!)

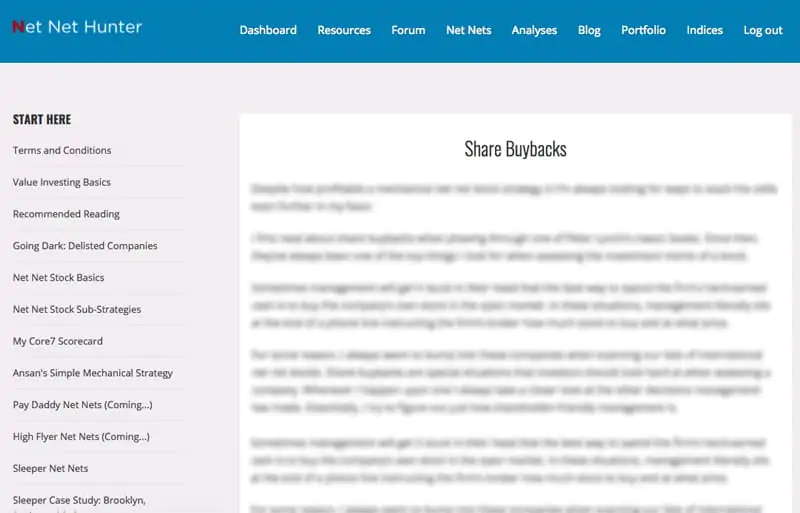

Net Net Stock Educational Resources

Learn how to turn cash in the bank into a portfolio of great net net stocks. We've put together articles and guides vital for success with net net investing.

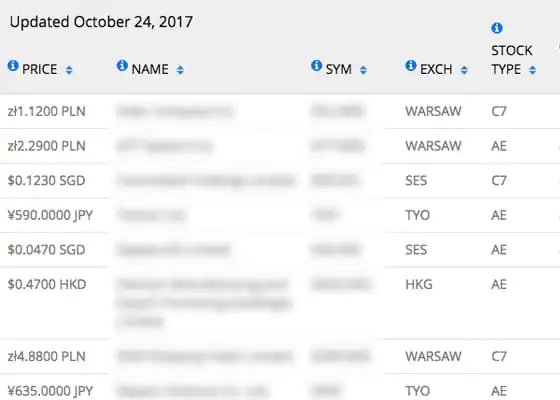

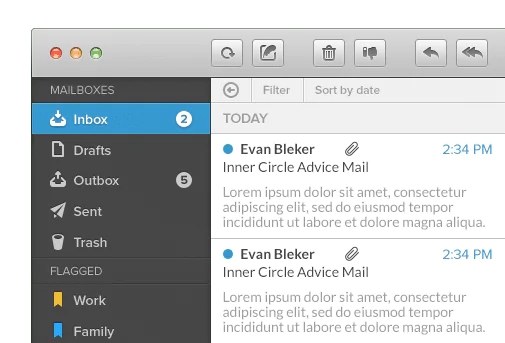

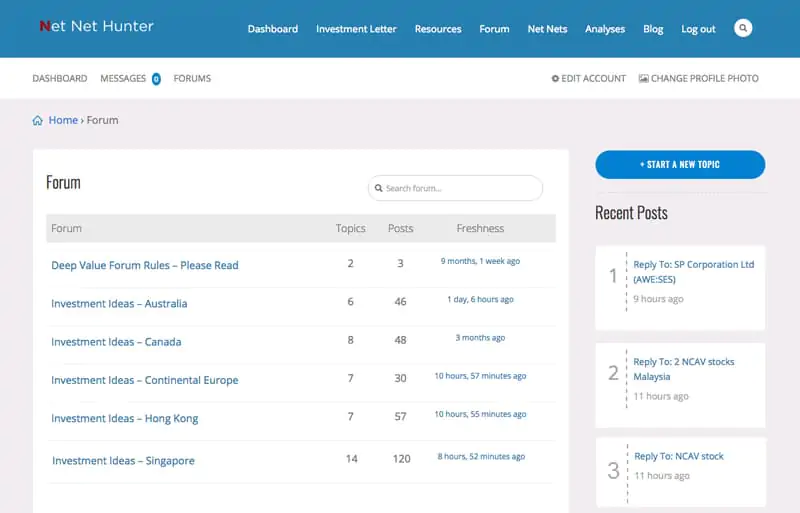

Inner Circle Forums

Discuss investment ideas, net net stock investing strategies, books and a range of other value investing topics. Our Inner Cirlce Forum brings together dedicated deep value investors from all over the globe. More

Net Net Hunter Features In Depth

Shortlists of High Potential Net Net Stocks

Get quick access to the best net net stocks to research. Every month we spend 20 hours digging through 1000 NCAV stocks from 28 countries to bring you the absolute best 30 opportunities. We hand pick stocks for our Shortlist using a number of scientifically proven quality factors, and timeless investment principles from great investors such as Warren Buffett and Seth Klarman. Our foundation is very much Graham and Dodd but our focus is evidence based investing that leverages contemporary scientific studies.

Inner Circle Forums

Discuss investment ideas, net net stock investing strategies, books, and a range of other value investing topics. Our Inner Circle Forum brings together dedicated deep value investors from all over the globe. We’ve formed a high-calibre community of investors which include financial professionals, analysts, tiny fund managers, as well as regular retail investors and new investors just starting out.

International Raw Screens

Use your own skill to identify net net stocks that meet your own particular deep value investment style. You get access to over 1000 net net stocks in the USA, the UK, Continental Europe, Canada, Australia, Singapore, Hong Kong and Japan. We cover over 28 markets and add more markets based on member demand. You can also download our stock screens as Excel files (pictured left).

Net Net Stock Educational Resources

We’ve gathered every critical piece of writing on net net stock investing to help you develop your strategy. New to investing? We have specific articles to teach you how to invest. Learn how to turn cash in the bank into a portfolio of high potential net net stocks.

Net Net Index

Track your portfolio’s performance against our international net net stock indices. We’ve created the first and only set of net net stock indices available anywhere. Our indices include available net nets in all 28 countries, an index of discounted net nets, plus our own Net Net Hunter Shortlist.

Inner Circle Advice Emails

It’s incredibly important that you understand the big picture when it comes to net net stock investing so we’ve crafted this series of emails to do just that. A key part is advice on how to start if you’re new to net nets. This bird’s eye look is critical for helping you stay the course and earn exceptional long term returns. We want you to win.

Net Net Stock Research Analyses

You get 12 research analyses per year produced by Evan and our experienced value investing analysts. Each stock analysis covers a net net we’ve identified as a good buy, and we often have ownership stakes in these companies ourselves. If you’re new to net net stock investing, you can use this analysis to supplement your own net net picks or gain insight into how we think about investing.

Upgrade Your Net Net Hunter Membership

$100 Off For Pro Pack Subscribers Only!

Upgrade your membership with a subscription to The Value Investing Sage Investment Letter offered via our sister site The Value Investing Sage. You’ll get access to 36 additional high quality stock analyses. Created for investors who lack the skill or time needed to invest well, both financial professionals and individuals have found our investment letter incredibly useful. It’s a complete do-it-for-me value investing solution.

36 Stock Analyses Per Year

Get 3 stock analyses per month sent straight to your email inbox. Our experienced deep value analysts scour global markets for high quality deep value stocks. Each analysis includes an overview of the company, follows our stick selection criteria, peers into the company’s qualitative situation, and ends with a thorough valuation and buy recommendation.

5 Of The Highest Returning Deep Value Strategies

Perfect for either pros who need larger liquid investments for clients, or individuals with small portfolios. We leverage 5 of the highest returning deep value strategies: Ultra cheap price to net tangible assets, Pay Daddy dividend paying net net stocks, Negative Enterprise Value firms trading below distributable cash, Simple Way 2.0 stocks based on Graham’s last stock strategy, and Acquirer’s Multiple, low EV/EBITDA stocks.

12 Investment Resource Or Book Reviews Per Year

We break down the books we’re reading and the tools we use to do our job so you can become a better investor. There's an ocean of books out there so we’ll help focus your attention on the content you should read to improve your understanding of mechanical deep value investing.

Complete Portfolio Construction & Management Guidance

We do all of your investing for you: hunt for great opportunities, research your stocks, present you with the stock analyses, tell you when to buy, how to fit them into a portfolio, and when to sell each stock. All you have to do is execute the trades. To help, we’re including our Portfolio Construction 101 investing guide, a fundamental overview of how to construct a mechanical value investing portfolio, and we track all stocks for a year after analysis. When it comes to value investing, this is the easiest way possible to earn great returns.

Bird’s Eye View Investment Guides

Get a complete bird’s eye view look at each investment strategy we cover, 5 total, a PDF copy of the checklists we use for our analyses, and a detailed discussion of how we crafted them. There is no black box. You will understand exactly how we’re selecting our stocks and why.

What Our Members Say About Net Net Hunter

See why successful investors trust Net Net Hunter and rely on it for their investing research

Net net hunter makes selecting net nets really easy by having a shortlist of international stocks ready to go. The stocks are filtered through their scorecard to increase the odds of picking winners and helps you understand what process is being used.

Gorilla ROI

I went to his site and I was amazed by the amount of content that he had. It’s really very high quality stuff. There are not a lot of websites that talk about Benjamin Graham style investing and it was like a gem in a lot of rubbish sites. So, I persuaded my business partners to sign up for a Net Net Hunter subscription and inside the membership we found even more gems — Evan talked about stocks, analyzed net net stocks in detail, and not just in a particular country such as in the US which most sites cover, he also went into the UK, Japan, all these countries uncovering net net stocks.

Big Fat Purse

So, if you read this, you done enough research to understand value. Now, imagine hiring a researcher to go through all the hassle, plus subscriptions, to find the best net nets. That would run into the thousands of dollars per month... But not anymore. Net Net Hunter is a "no brainier"! And the education comes for free! That's value.

Founder of Financially Free Podcast

Net Net Hunter is a great resource for deep value investors. The articles and resources cover a wide range of subjects related to investing and are very unique in their content. The global community of investors is a great resource for ideas and research. Net Net Hunter opened my eyes to a totally different way to think about investing and I'm a better investor because of it.

Partner at Kiefaber & Oliva LLP

Net Net Hunter is an essential tool for me as a private investor. First of all, it is a source of investment ideas. The shortlist and the raw list are great hunting grounds for those of us who look for deep value opportunities. But most importantly, it is a community of very knowledgeable investors from all around the world, who like to share their experiences and ideas, and have fun learning about very broad topics. Having Evan running the place and sharing his vast experience with all of us is the icing on the cake.

Portfolio Manager at Centrica Portfolio Management

Net net hunter is a great resource for those looking for a way to invest in bargain stocks. I have learned so much from joining the Net net hunter community and it has advanced my knowledge of stock market investing.

Member

Take a Look Inside

Curious about what kind of content we offer on the inside? Have a look at key parts of the members section below.

The Energy Life

Evan is really personable and has helped me understand net net stocks and how to invest in them. His investment shortlists really help minimize the work necessary to put together a good portfolio.

NET NET HUNTER MEMBERSHIP

$49.99

per month (charged annually, recurring)

MOST POPULAR

NET NET HUNTER PRO PACK

$95.83

per month (charged annually, recurring)

Frequently Asked Questions

Answers to some common questions people have before joining.

Q: Are there enough net net stocks right now to put together a well diversified portfolio?

Q: I’m American so I can’t invest internationally. What can I do to invest in net net stocks?

Q: I’m American, so the tax complications of investing international are a nightmare. How do I get around this?

Q: If I'm not happy with the service, can I get a refund?

Q: If I join now, will my membership fees ever change?

Q: What do you mean by hand-picked stocks?

Q: What are "Investment Research Reports" and what's included as a part of it?

Q: How many Investment Research Reports will I get each month?

Q: How often are your stock screens updated?

Q: What metrics are found on your stock lists?

Q: Why do your metrics differ between the two screens?

Q: Are net net stocks penny stocks?

Q: What countries or markets do you cover?

Q: Will you increase your coverage to include other countries?

Q: I don’t know how to invest in net net stocks but I’d like to learn from somebody. Can you help me?

Q: Do you cover NNWC stocks? If not, why not?

Q: Do we get access to your personal portfolio?

Q: How do I cancel my membership?

NET NET HUNTER MEMBERSHIP

$49.99

per month (charged annually, recurring)

MOST POPULAR

NET NET HUNTER PRO PACK

$95.83

per month (charged annually, recurring)

Don't Wait – You Only Have One Life

Imagine how you would feel at the age of 60 knowing that you could have invested in Benjamin Graham's most profitable investment strategy, but didn't. Don't waste this opportunity. The amount of money that you'll inevitably make off of even just one of our stock ideas would be enough to pay for membership for years... and we've identified nearly 30 fantastic investment opportunities. Don't wait. Join Net Net Hunter right now.