Net Net Stocks: An Outstanding Investment Strategy

There is a lot of irrationality on Wall Street.

Image Trumps Reality

In university economics professors in aging sports coats would stand at the front of the lecture hall and declare – straight faced - that businessmen are rational creatures, making the best choices possible through a thorough examination of the available data. When I started investing and learning about markets I discovered that that just wasn’t the case. Investing, it seems, sparks a whirlwind of irrational drives.

In one of the first sentences in the classic book, “The Money Game,” itself an engaging social critic of the investing world, Adam Smith describes his book as “a book about image and reality and identity and anxiety and money.” Not exactly a sentence that inspires confidence in the captains of Wall Street.

Stock charts and new technology. Relative strength and quarterly projections. I still find it shocking that people in high finance or at home in their den don’t find out what actually works before they start investing. Instead, they buy what they’re sold – either by their local mutual fund pusher, or by the never-ending cable tv media circus. The image – in a very real way – is more sought after than actual success.

If You Want Success You Need Rationality... or Lots of Luck

A couple of years ago I was lucky enough to convince my father to seek out money managers who use a value approach. Not being the investing type, he was eager to find a place to put his money so buried his head in Morningstar fund returns trying to select a money manager.

Measuring past performance is tricky. If you’re putting money into a mutual fund you can’t just look at the returns on file and conclude that the fund manager was some sort of genius or idiot. You have to look at the larger context in which it takes place and realize some obvious truths about the nature of investing.

One of the biggest is that any backwater manager can – by luck – find himself on the crest of a great wave, an enormous market trend that propels his mutual fund returns skyward. With the large number of fund managers in existence it’s inevitable that in any year or decade some of those managers will find themselves in the right place at the right time and ride that wave for all its worth. It takes no investing skill. In these cases it’s just a mater of chance.

Fill your portfolio full of high potential, low risk, net net stocks. Click Here.

That is part of the problem with growth (or “momentum”) investing. It is very hard to tell the managers who lucked out from the ones that were on the right side of fate. Value investing, by contrast, is entirely different. Trends are the antithesis of value investing. Classic value investors are especially immune to this kind of market luck. They buy stocks that were beaten down relative to some value measure and then sell when those stocks become fairly valued. There is no wave-riding which makes assessing the skill of a value manager tremendously easier.

Warren Buffett's Early Magic

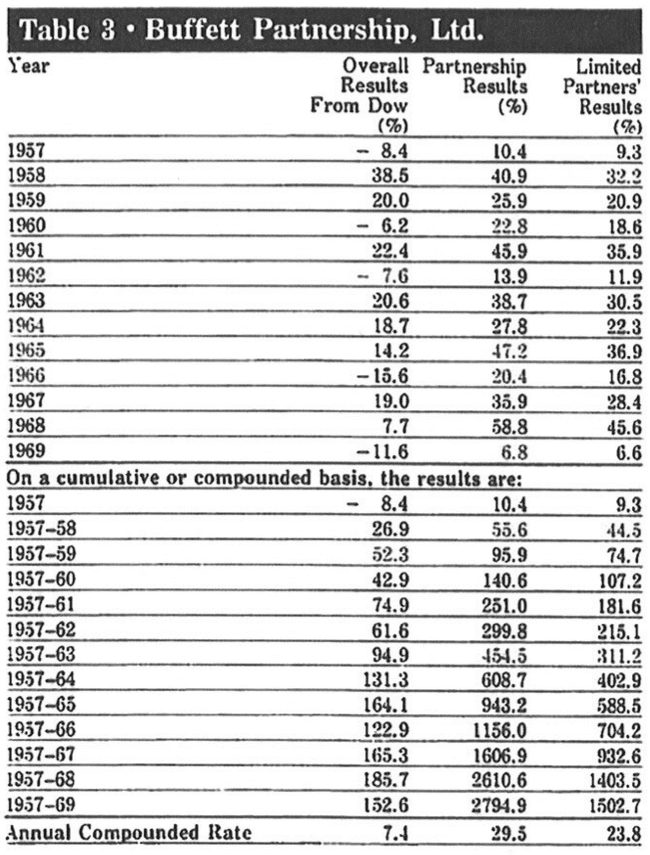

Investors should be picking their investment strategy the same way. They should be looking at what has worked in investing, applying some basic critical thinking, and following a sound strategy. One of the best ways to assess an investing strategy is to look at the people who have used it. When it comes to value investing, nobody is better than Warren Buffett. Buffett is the golden standard by which all other investors are measured and his track record shows why.

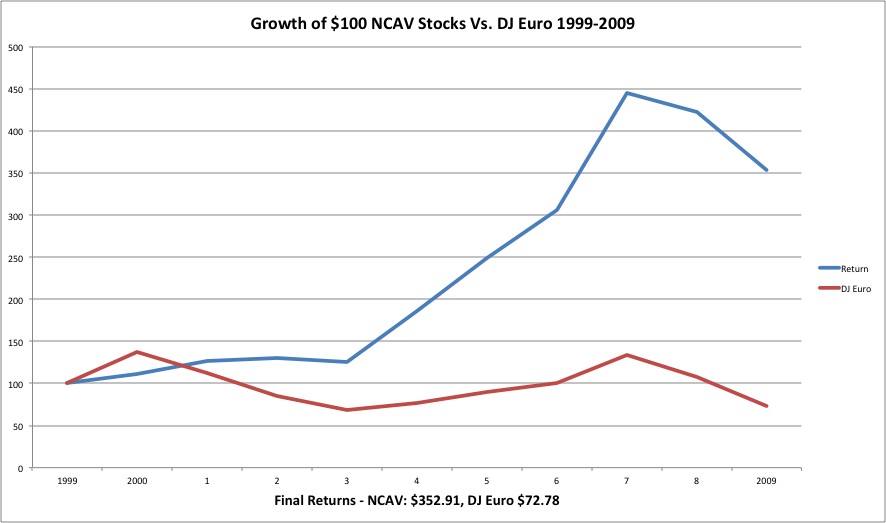

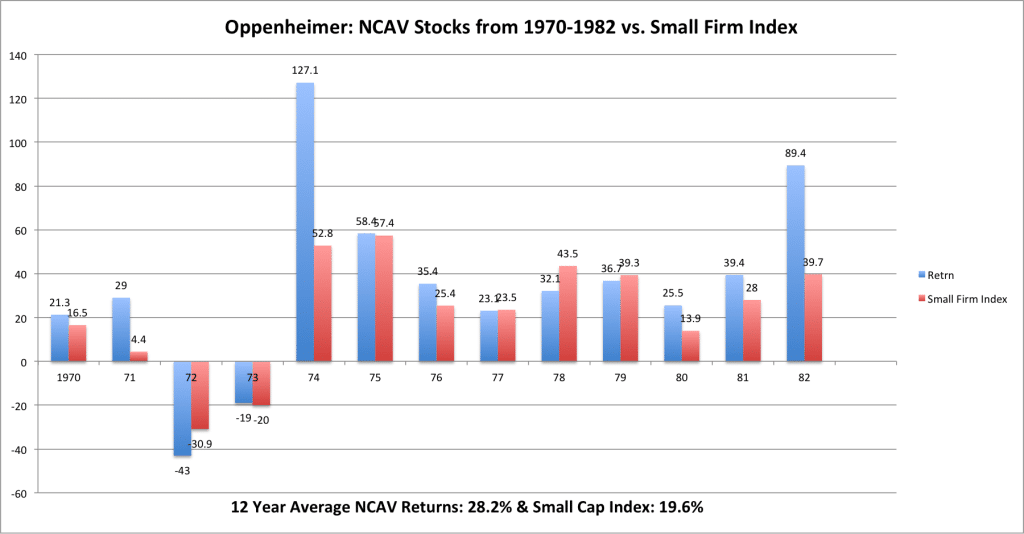

It’s notable that these returns are largely the result of his focus on net net stocks. After Buffett left Graham-Newman he put to work the investment methodology that worked so well for his mentor. He started focusing on finding net net stocks because he knew how well these investments performed as a group and what he could do to up his returns.

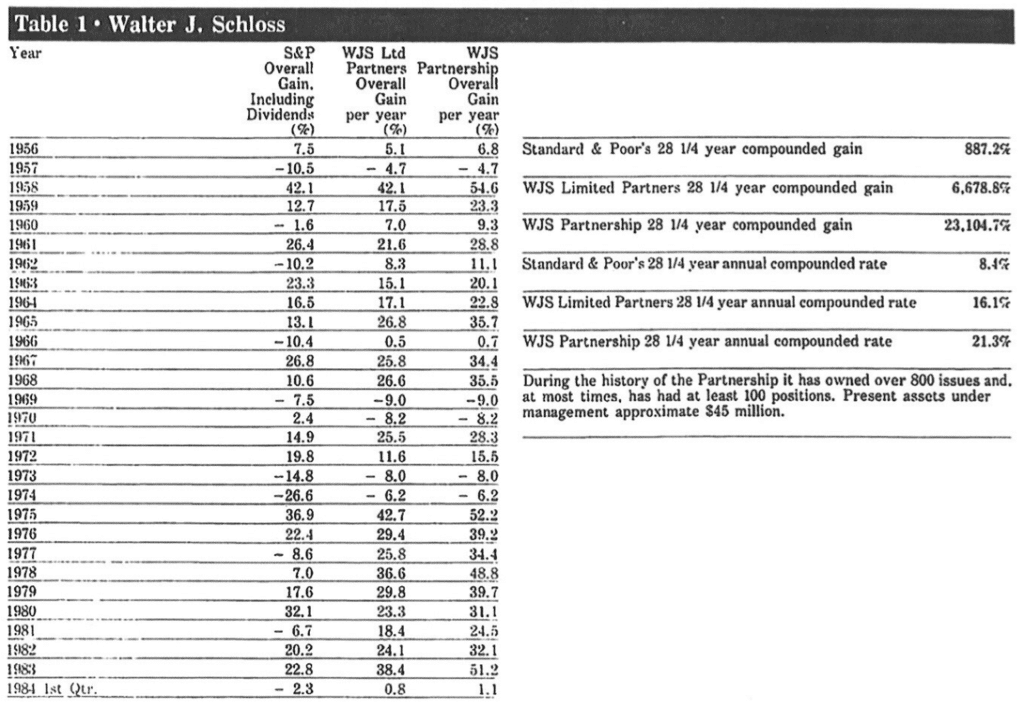

Buffett wasn’t alone. Walter Schloss, another former employee of Graham-Newman, put the same value style to work and earned a great investment track record over the life of his partnership. While his portfolio is too large to invest solely in net net stocks today (one of the major advantages of this strategy), even now he still basses his investment style on the same core principles.

I heard about net net stocks years ago but never spent the time exploring the strategy. I heard that they were basically non-existent for modern investors, but that proved to be very wrong. What drew me to the style initially was the amazing returns I could earn with comparatively little work. Essentially all an investor has to do is put money into a basket of these stocks and then replace that basket after a specified holding period. Alternatively, an investor could replace stocks that rise to full value with other NCAV stocks. When I heard about it, the whole process seemed very straightforward, very simple, and very profitable.

And in my experience the investment strategy is just that: straight forward, simple, profitable. Even now when I reread the academic studies that eventually sold me on the investing style, they all seem to accurately reflect my own experience investing in net net stocks. Net nets have been extremely profitable and have been fairly easy to select. Since adopting the investment style, my portfolio has really taken off.

Fool's Gold?

If things are that good then why wouldn’t people adopt the style as their primary investing strategy? Of course, no investing method is perfect. For one, net net stocks – at least the ones trading for a steep enough discount – can be very hard to find under normal market conditions. At any time there could only me 5-10 net net stocks that I would invest in if only looking at the American markets. Expanding my scope to friendly international markets such as London, Toronto, or Sydney, the number of desirable net net stocks rises dramatically.

But finding them takes a lot of digging.

This is probably one of the major reasons why retail investors don’t pursue this strategy more aggressively. Retail investors are regular people with jobs and family obligations so just can’t spend the time it takes to find these stocks. If they want to invest on their own they've had to opt for a strategy that takes a lot less work to search out decent investments. Unfortunately, this only hurts their long term finances since pretty much no other strategy offers returns as great as net net stock investing. Ultimately, adopting another strategy means growing a much smaller nest egg and the amount of forfeited profit can be staggering - we're talking millions of dollars.

Those with millions of dollars already are priced out of the game. Net net stocks are small and many have low trading volumes. That means that professional investors, even those with small portfolios, just can't invest in enough NCAV stocks to make a sizeable difference to their portfolio returns. Retail investors investing less than $5-10 million can take advantage of their small size and buy shares in financially solid but tiny and relatively illiquid companies that trade for deep discounts to fair value. They can also find enough of these to put together a strong net net stock portfolio. These are the kind of opportunities that smart professional investors would scoop up quickly if they could.

Not looking into low-price-to-NCAV investing earlier was a major mistake on my part. I don't even want to think of how many thousands of dollars I've missed out on because I believed the drumbeat chant that net nets were dead, that investors just can't find them anymore. Since starting down the road of net net stock investing I've been really impressed with just how simple this strategy is and how effectively it works. Take your financial future in your own hands - join Net Net Hunter today. The amount of money you can make off of even just one stock pick is enough to pay for membership for years to come.