Tweedy, Browne Net Net Stock Darling Shinko Shoji

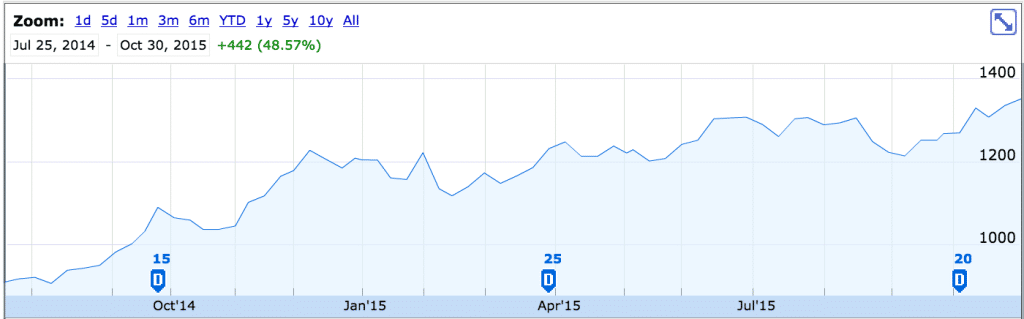

Tweedy, Brown net net darling Shinko Shoji is now up 49% from Net Net Hunter's initial review of the company in July of 2014.

Last month it came out that legendary value investment firm Tweedy, Browne had added the electronics manufacturer to its portfolio. At the time of the disclosure, Tweedy Browne owned 1.77% of the firm's outstanding shares.

Net net stocks don't allow for significant investment by large professional investors since firms are often too small to accommodate a large capital investment. The fact that the classic value firm added the stock to their portfolio at all, rather than another value stock that could accommodate more capital investment, is a strong indication that they expect good things from Shinko Shoji going forward.

Tweedy, Browne has long favoured classic value stocks when it comes to investing their own money, and net net stocks in particular. In the firm's well-known white paper, "What Works In Investing," company cofounder Chris Browne highlighted the fantastic record of net net stocks and revealed their preference for these types of investments after more detailed analysis.

"Stocks trading at 66% of net current assets (NCAV) or less have been few and far between in the stock market, and when we do uncover them, they are often micro- capitalization companies that can accommodate only modest levels of investment. That said, they do turn up from time to time, and when they do, we study them as prospective investment candidates."

Shinko Shoji obviously fit the bill as a serious investment candidate. When the company was selected for analysis, the stock was trading for just under 1000 Yen ($8.30 USD) per share which amounted to just 46% of net current asset value.

Warren Buffett's famous teacher, Ben Graham, originally developed the investment strategy in the 1930s after witnessing the devastating market crash which saw many investors lose the bulk of their savings. The strategy was intended to be an ultra-conservative framework for investment, allowing significant returns while protecting downside vulnerability. Graham suggested that investors pick up shares at no more than 67% of net current asset value, and hold a large diversified portfolio of these types of stocks.

The initial analysis of Shinko Shoji also revealed that the company was cheap relative to other classic value metrics. It's PE was just under 8x earnings, PB just 41%, and its Price to Sales ratio came in at a tiny 15%. The company also recorded a dividend yield of 3.3%. In all respects, Shinko Shoji was a significant bargain.

"It's important to note that when it comes to net net stocks I see dividends as a weakness," Evan Bleker mentioned in a yet to be released interview with Endless Rise Investor. "I don't want to see net nets stocks issuing dividends because net nets that issue dividends are associated with lower returns."

One can only imagine what the return would be for Shinko Shoji today if it had reframed from issuing dividends.

"My own returns on Shinko Shoji have been good, but I bought the firm a month and a half after the analysis came out so my own holding is only up 36% excluding dividends. That's still really good, but not as good as it could have been if I had of picked up the shares immediately after publication."

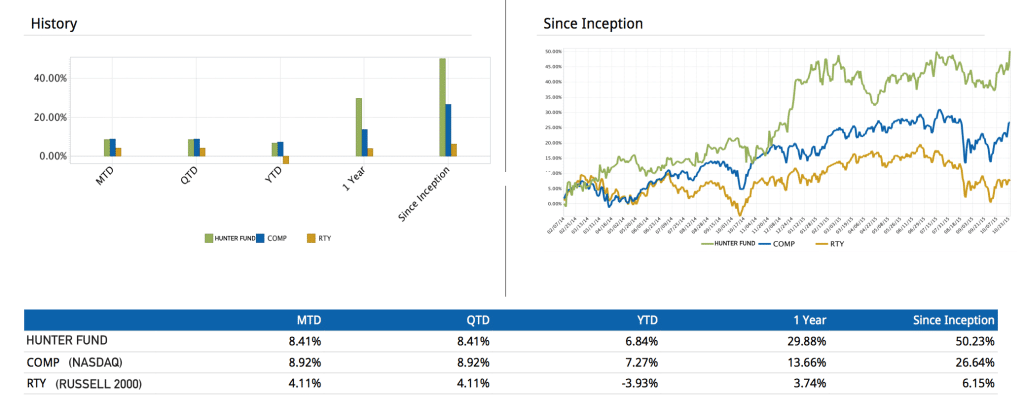

Evan wouldn't comment on the other holdings in his portfolio but mentioned that he was up just under 30% over a one year period compared to 13.66% for the NASDAQ.

Often net net bargains come at the expense of quality. NCAV is a quick and dirty assessment of liquidation value and shareholders only sell firms for less than liquidation value due to extreme pessimism about the company's future. But, while net net stocks are often just thought of as deep value investments, they can also provide a significant amount of growth if the stock is trading so cheaply due to investor disinterest or neglect.

In the case of Shinko Shoji, its liquidation value was actually increasing year over year since 2006. In the prior 12 months, the firm's NCAV had increased by over 11%. Earnings were another story altogether, increasing by a CAGR of more than 22% over the same period, proving that a net net stock can also certainly be classified as a growth stock.

"There aren't a lot of companies like these, and there are almost none in the West," Evan commented. "But, these are the sorts of firms that I like to buy because their record of outperformance is so good. Right now if you want to find them then you have to hunt for net nets in depressed international markets. We're finding a lot of them in Japan."

Is Shinko Shoji a buy now?

"Above everything else, you want to diversify your portfolio over maybe, say, 20 positions. Fewer if you're picking nothing but stocks like Shinko Shoji and more if you're picking your regular run of the mill net nets," Evan cautioned. "The way I looked at this stock was that I didn't know whether it would produce a good return but the characteristics of the company definitely stacked the odds in my favour."

Another core criteria that Evan has stressed has been the need to buy net nets at a solid discount to NCAV. Doing so helps absorb the impact of being wrong about an investment and provides much higher investment returns.

Joel Greenblatt, however, tested net net stocks that also recorded low PEs at a much shallower discount and found that the returns were still excellent. His study looked at net nets trading at either no discount or a razor thin 15% below net current asset value. He held the stocks for only a year or until their share priced doubled, and recorded a CAGR north of 20% per year during a flat market.

With Shinko Shoji currently sporting a PE of 15x earnings, a Price to NCAV of 73%, and now with Tweedy, Browne's recent buy, maybe there's still life in the stock yet.

You can identify more companies like Shinko Shoji by downloading our Net Net Hunter Scorecard. Click Here.