Investment Strategy for Profit Despite Market Overvaluation

Have you seen the price of Best Buy recently? Since January the company's stock has shot up over 200% -- not bad for a company that is losing money. Of course, a 200% increase in price is not uncommon among deep value stocks but it's not nearly as common in mega-cap retail stocks. As of the time of writing this, investors are more or less pricing the company based on the company's solid 2010 earnings, and at roughly 3x book value. Pretty good for a 9 month return.

Over the same time period the S&P 500 nailed a 16% return, and the DOW etched its way up to 15 072 where it currently rests at its all time high. While huge jumps in large cap stocks and markets reaching all time highs are not alone cause for concern, it should raise eyebrows and cause investors to ask where we are in the business cycle.

There's Trouble Brewin'

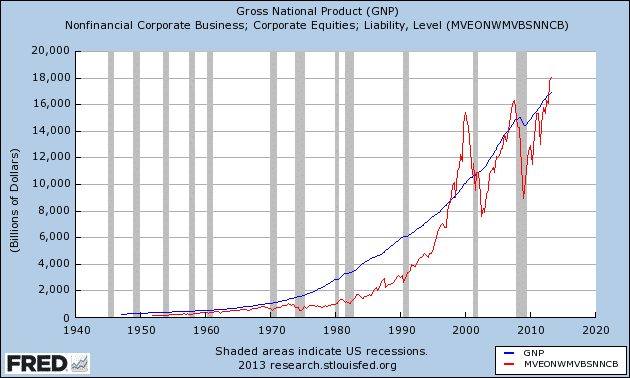

At least some smart writers are hinting at market over-valuation. In the first quarter of this year, Warren Buffett's favourite market valuation measure, GNP-to-total-market-capitalization, hit 110%, and the market has increased at least 5% since then. Historically, the ratio has averaged 69%, making the market's current valuation much higher than smart investors should feel comfortable with.

Fill your portfolio full of high potential, low risk, net net stocks. Click Here.

So what does that mean? Clearly at higher market levels value investors start to find it very difficult to find stocks. Net net stock investors are no different. As the general market level rises, the number of net net stocks in the market shrinks dramatically, making it very tough for a classic Graham investor to put a portfolio together. While the market is not as high as it was in the hight of the mid 2000s -- 150 vs. 110 -- at least a few major investor have started to complain about the lack of opportunities and one, Seth Klarman, has even started to return money to investors.

What is an Investor to Do?

In overheated markets, value investors have to make some tough investment choices. One option for deep value investors is to abandon their preferred standards. Since good investments are tough to find, relaxing investment standards -- perhaps accepting investments with smaller margins of safeties in terms of price or investing in firms that have taken on too much debt -- may seem attractive. If an investor widens the pool of investment candidates, he can definitely find more investment opportunities. According to Snowball, Buffett's all-access-pass biography, this is something Buffett himself did when times got tough… only to regret it later. In general, relaxing your investment standards is a bad choice. If you chose to accept stocks with a smaller margin of safety in terms of price you're both exposing yourself to more downside if the market drops and accepting a much smaller upside if things work out. Essentially, you drastically shift the odds of making good profits away from you. The same goes with accepting a firm that has too much debt -- while the upside may materialize the downside can become devastating should things go wrong.

Ditto for portfolios constructed by investors who have chosen to abandon their investment strategy. Back in the late 1990s investors, fed up with the tiny returns their

value portfolios were making and seeing the huge gains made by technology stocks, abandoned the former for the latter. We all know how that ended. While we're definitely not seeing that level of exuberance in the market today -- yet -- past mistakes should make investors very cautious about abandoning techniques that have worked so well for so long. Investors should be doubly cautious of this during bull markets.

The other obvious choice is to sit and wait for the market to stop frothing. This would at least have the advantage of avoiding catastrophic portfolio failures when things finally turn but there's another equally damaging threat: market stagnation. There is no law that states that an overvalued market must correct itself within a reasonable length of time. As time passes, inflation starts to erode the real value of the cash in your portfolio and your compound average returns begin to flatline. Even if the market doesn't shoot sideways, bull markets can last for years, pushing stocks to even higher levels of overvaluation and keeping value investors out of the market. In these situations, investors can see their portfolio returns erode for the exact same reasons. Sitting on the sidelines is no place for an active money manager.

The International Option

Luckily for value investors, while domestic markets may be overvalued it's not the case that markets are overvalued everywhere. If investors want to keep making adequate returns, the best option is to start looking at international stock markets for value. Recently, Nate at Oddball Stocks decided to explore the Japanese markets with amazing results. While not every stock market deserves an investor's attention, low price to net current asset value investors can increase their portfolio returns by thinking internationally.

That's why Net Net Hunter screens for stocks in international stock markets, not just stocks on American exchanges. If you want to invest in the best opportunities available to you then you have to start looking globally. There are enough friendly, English Speaking, countries with solid financial systems and first rate stock markets to keep an investor busy most of the time. Add to that the fact that net net stocks do just as well on international markets as they do in America and you have a very strong incentive to start looking outside of your own domestic market.

You can start by signing up for full Net Net Hunter membership. The money you could make off of even just one international net net stock would be enough to pay for full membership access for years. ...and right now we have over 400 stocks to look at.

Not ready for full membership? That's fine. Just sign up for the free net net stock essential guide in the box below this article. No commitment, no obligation, and we keep your email address 100% confidential. Don't wait. Sign up now so you can start making 25%+ annual returns through net net stocks.