BUILD A HIGH QUALITY NET NET PORTFOLIO QUICKLY AND EASILY

Subscribe Through The Intelligent Investing Podcast To Save $100 And Get 6 Bonus Investment Guides...

As Part Of Your Membership...

Net Net Hunter is the only members site 100% dedicated to classic net net stock and cigar butt investing. Check out everything we offer below.

Shortlists of High Potential Net Net Stocks

Get quick access to high potential net net stocks – many poised to double within a year.

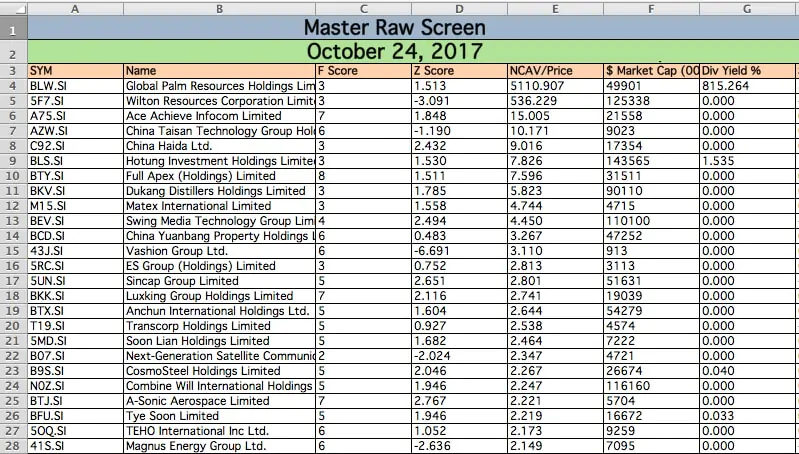

International Raw Screens

Browse over 1000 net net stocks from the USA, the UK, Continental Europe, Canada, Australia, Singapore, Hong Kong and Japan (28 countries total!)

Net Net Stock Educational Resources

Learn how to turn cash in the bank into a portfolio of great net net stocks. We've put together articles and guides vital for success with net net investing.

Discuss investment ideas, net net stock investing strategies, books and a range of other value investing topics. Our Inner Cirlce Forum brings together dedicated deep value investors from all over the globe. More

Net Net Hunter Features In Depth

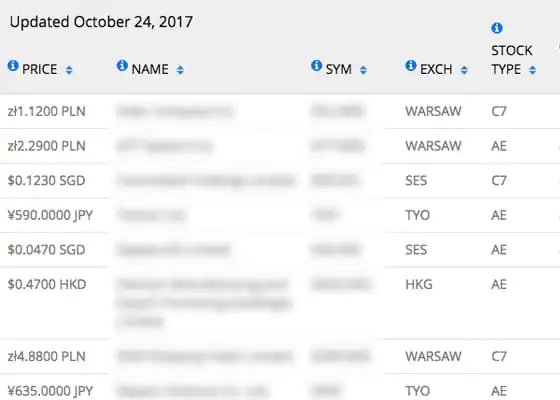

Shortlists of High Potential Net Net Stocks

Get quick access to the best net net stocks to research. Every month we spend 20 hours digging through 1000 NCAV stocks from 28 countries to bring you the absolute best 30 opportunities. We hand pick stocks for our Shortlist using a number of scientifically proven quality factors, and timeless investment principles from great investors such as Warren Buffett and Seth Klarman. Our foundation is very much Graham and Dodd but our focus is evidence based investing that leverages contemporary scientific studies.

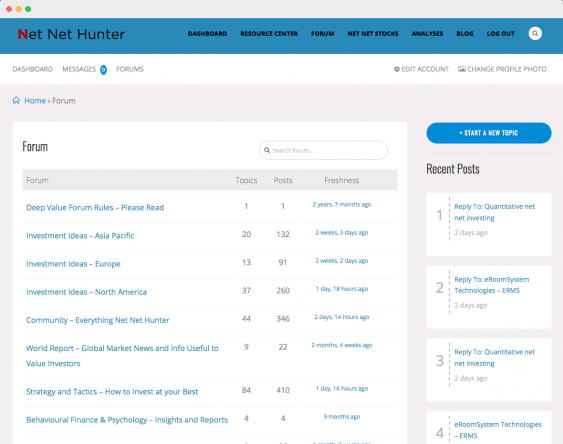

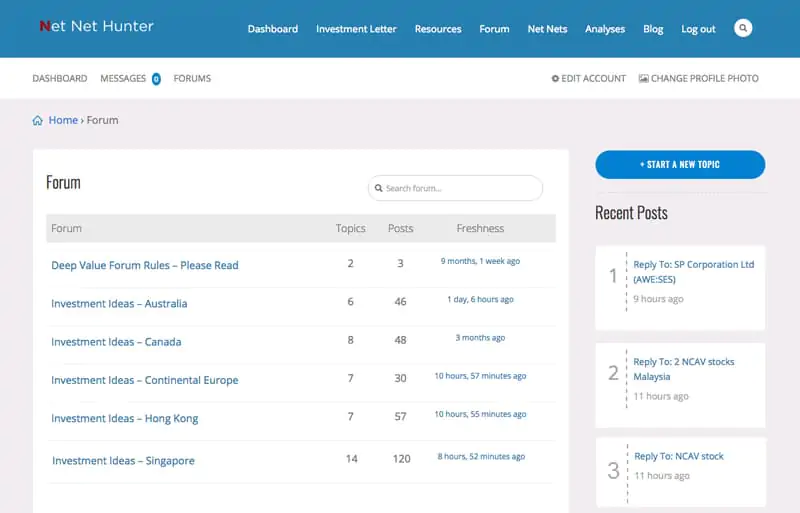

Inner Circle Forums

Discuss investment ideas, net net stock investing strategies, books, and a range of other value investing topics. Our Inner Circle Forum brings together dedicated deep value investors from all over the globe. We’ve formed a high-calibre community of investors which include financial professionals, analysts, tiny fund managers, as well as regular retail investors and new investors just starting out.

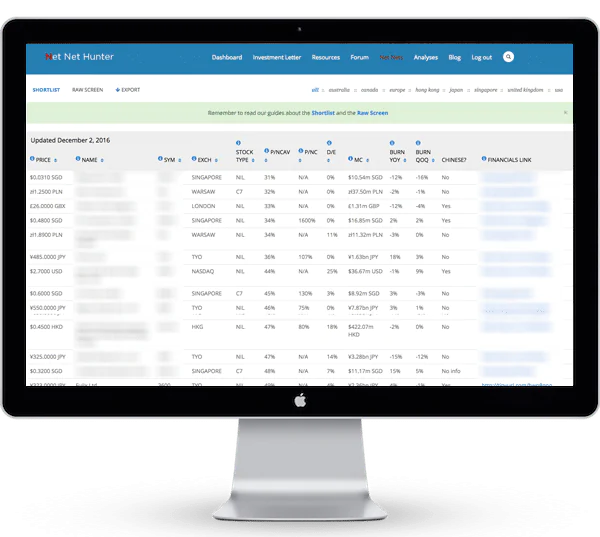

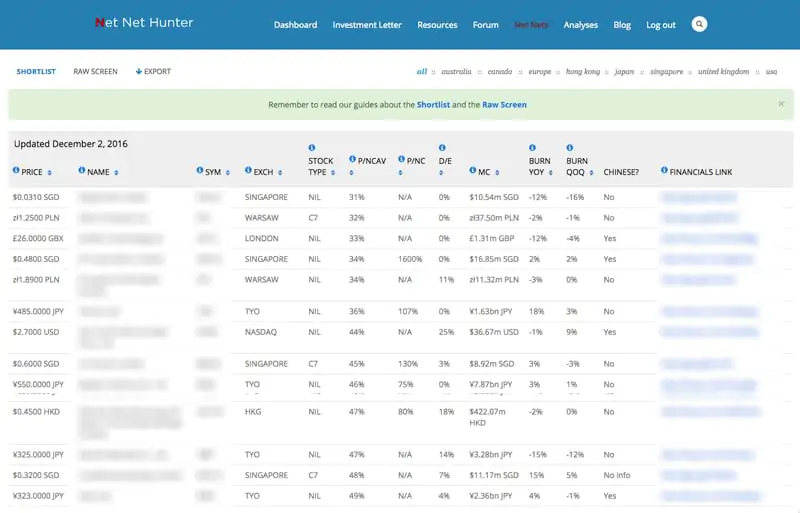

International Raw Screens

Use your own skill to identify net net stocks that meet your own particular deep value investment style. You get access to over 1000 net net stocks in the USA, the UK, Continental Europe, Canada, Australia, Singapore, Hong Kong and Japan. We cover over 28 markets and add more markets based on member demand. You can also download our stock screens as Excel files (pictured left).

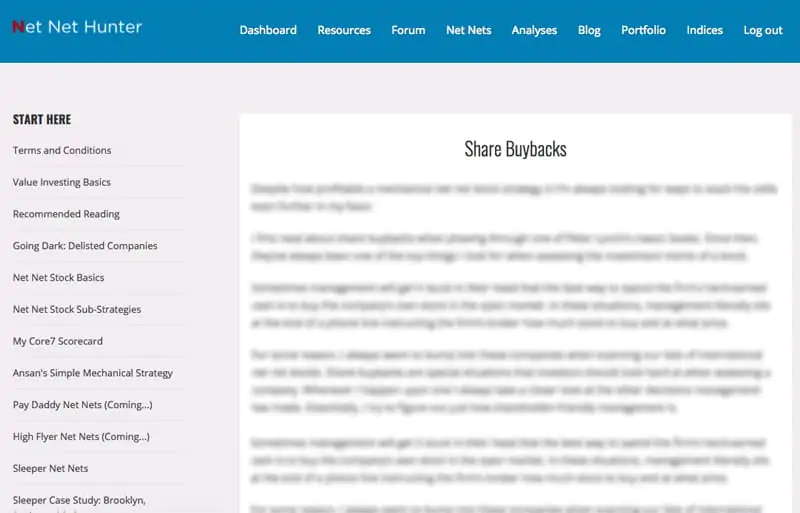

Net Net Stock Educational Resources

We’ve gathered every critical piece of writing on net net stock investing to help you develop your strategy. New to investing? We have specific articles to teach you how to invest. Learn how to turn cash in the bank into a portfolio of high potential net net stocks.

Net Net Index

Track your portfolio’s performance against our international net net stock indices. We’ve created the first and only set of net net stock indices available anywhere. Our indices include available net nets in all 28 countries, an index of discounted net nets, plus our own Net Net Hunter Shortlist.

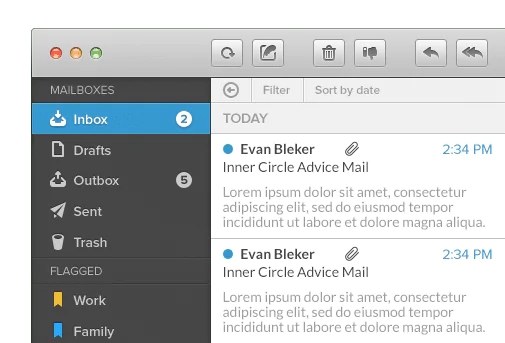

Inner Circle Advice Emails

It’s incredibly important that you understand the big picture when it comes to net net stock investing so we’ve crafted this series of emails to do just that. A key part is advice on how to start if you’re new to net nets. This bird’s eye look is critical for helping you stay the course and earn exceptional long term returns. We want you to win.

Net Net Stock Research Analyses

You get 12 research analyses per year produced by Evan and our experienced value investing analysts. Each stock analysis covers a net net we’ve identified as a good buy, and we often have ownership stakes in these companies ourselves. If you’re new to net net stock investing, you can use this analysis to supplement your own net net picks or gain insight into how we think about investing.

Upgrade Your Net Net Hunter Membership

$100 Off For Pro Pack Subscribers Only!

Upgrade your membership with a subscription to The Value Investing Sage Investment Letter offered via our sister site The Value Investing Sage. You’ll get access to 36 additional high quality stock analyses. Created for investors who lack the skill or time needed to invest well, both financial professionals and individuals have found our investment letter incredibly useful. It’s a complete do-it-for-me value investing solution.

36 Stock Analyses Per Year

Get 3 stock analyses per month sent straight to your email inbox. Our experienced deep value analysts scour global markets for high quality deep value stocks. Each analysis includes an overview of the company, follows our stick selection criteria, peers into the company’s qualitative situation, and ends with a thorough valuation and buy recommendation.

5 Of The Highest Returning Deep Value Strategies

Perfect for either pros who need larger liquid investments for clients, or individuals with small portfolios. We leverage 5 of the highest returning deep value strategies: Ultra cheap price to net tangible assets, Pay Daddy dividend paying net net stocks, Negative Enterprise Value firms trading below distributable cash, Simple Way 2.0 stocks based on Graham’s last stock strategy, and Acquirer’s Multiple, low EV/EBITDA stocks.

12 Investment Resource Or Book Reviews Per Year

We break down the books we’re reading and the tools we use to do our job so you can become a better investor. There's an ocean of books out there so we’ll help focus your attention on the content you should read to improve your understanding of mechanical deep value investing.

Complete Portfolio Construction & Management Guidance

We do all of your investing for you: hunt for great opportunities, research your stocks, present you with the stock analyses, tell you when to buy, how to fit them into a portfolio, and when to sell each stock. All you have to do is execute the trades. To help, we’re including our Portfolio Construction 101 investing guide, a fundamental overview of how to construct a mechanical value investing portfolio, and we track all stocks for a year after analysis. When it comes to value investing, this is the easiest way possible to earn great returns.

Bird’s Eye View Investment Guides

Get a complete bird’s eye view look at each investment strategy we cover, 5 total, a PDF copy of the checklists we use for our analyses, and a detailed discussion of how we crafted them. There is no black box. You will understand exactly how we’re selecting our stocks and why.

What Our Members Say About Net Net Hunter

See why successful investors trust Net Net Hunter and rely on it for their investing research

Net net hunter makes selecting net nets really easy by having a shortlist of international stocks ready to go. The stocks are filtered through their scorecard to increase the odds of picking winners and helps you understand what process is being used.

No other web-site will give you the information that Net Net Hunter provides. Even just purchasing the Shortlist stocks should give investors a huge return which will easily cover the subscription cost. You will not find a more knowledgeable person on the subject.

Zelakovic Investments Managing Partner

I must say that it is an extremely undervalued service and something I have been looking for, for a long time! Thanks again for providing the service! Your analyses are thorough, logically sound, and approached with the right amount of conservatism.

Professional Exam Tutoring Founder

So, if you read this, you done enough research to understand value. Now, imagine hiring a researcher to go through all the hassle, plus subscriptions, to find the best net nets. That would run into the thousands of dollars per month... But not anymore. Net Net Hunter is a "no brainier"! And the education comes for free! That's value.

Net Net Hunter is a great resource for those looking for a way to invest in bargain stocks. I have learned so much from joining the Net Net Hunter community and it has advanced my knowledge of stock market investing.

Take a Look Inside

Curious about what kind of content we offer on the inside? Have a look at key parts of the members section below.

Energetic Lifestyle Founder

Evan is really personable and has helped me understand net net stocks and how to invest in them. His investment shortlists really help minimize the work necessary to put together a good portfolio.

New Members Through The Intelligent Investing Podcast Save $100 Per Year Plus Get 6 Bonus Value Investing Guides

NET NET HUNTER MEMBERSHIP

per month (charged annually, recurring)

- 40 of the Best Net Net Shortlisted Each Month

- Raw Screens With Nearly 1000 International Net Net Stocks

- Access to Our Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

per month (charged annually, recurring)

- 40 of the Best Net Net Shortlisted Each Month

- Raw Screens With Nearly 1000 International Net Net Stocks

- Access to Our Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

Frequently Asked Questions

Answers to some common questions people have before joining.

Q: Are there enough net net stocks right now to put together a well diversified portfolio?

A: There definitely are. The catch is that you have to expand your horizons to net net stocks trading in other first world countries. When taking these other markets into account, there are more than enough net net stocks to put together a well-crafted NCAV stock portfolio. The idea that “net nets just don’t exist anymore” comes straight from the mouths of people who can’t look beyond their own immediate surroundings. Adopting that same assumption and missing out on adopting Ben Graham's net net stock strategy could ultimately cost you 20-35% on average per year, or over $1 000 000 USD by the time you retire. Get Access!

Q: I’m American so I can’t invest internationally. What can I do to invest in net net stocks?

A: If you’re American, you can definitely invest internationally. The bulk of our members are Americans who have decided to invest overseas to leverage Ben Graham's famous net net stocks strategy.

To help you, we’ve uncovered a number of different high quality brokers that take on American clients. These are large international brokers with strong reputations. Some of them offer very inexpensive trades while others offer additional service to high net worth clients. All of this information is available to members.

Q: I’m American, so the tax complications of investing international are a nightmare. How do I get around this?

A: Hire a tax accountant. It’s really that simple. A good tax accountant might charge you $300 USD at most to do your year-end taxes. That’s a small price to pay to achieve the returns on offer with Ben Graham's net net stocks.

Don’t lose the opportunity to make 20-35% average annual returns with net net stocks, which could amount to over $1 000 000 USD by the time you retire, just because you didn’t want to pay $300 a year for a good tax accountant. That would be tragic!

Q: If I'm not happy with the service, can I get a refund?

A: Unfortunately, we do not provide refunds for Net Net Hunter membership. Since Net Net Hunter members have immediate access to all investment analysis reports, we can't provide refunds once the service is started. ValueInvestingSage.com is responsible for all policies having to do with The Value Investing Sage Investment Letter. Please contact them for policy details.

Q: If I join now, will my membership fees ever change?

A: Your membership fees will never change as long as you're a member. If you join now for $599.99/year, for example, you could still be paying that same $599.99/year 20 years from now.

Q: What do you mean by hand-picked stocks?

A: Every month we spend 15 long hours combing through over 550 net net stocks to find the best possible investment candidates within each market. We then arrange these stocks into our Net Net Hunter Investment Shortlists so you can quickly identify the most promising investments quickly and easily.

How much is your time worth? An average worker in North America makes roughly $20/hour. If you spent 15 hours each month trying to identify the best net net stocks in each market, you would essentially be wasting $300 of your own time. After just two months, a yearly Net Net Hunter membership more than pays for itself.

Q: What are "Investment Research Reports" and what's included as a part of it?

A: An investment research report is a detailed research report showcasing either a special net net stock opportunity that we've uncovered, or a hidden landmine that you should keep far away from your portfolio. Both are key. After all, "Don't lose money," is the first rule of successful investing.

The length of each analysis varies, but all are based on Net Net Hunter's NCAV Investment Scorecard. Each includes: main quantitative characteristics of the company, a summary of the main business operations, the location of the company, a detailed account of how the company meets each one of Net Net Hunter's NCAV Investment Scorecard criterion, an account of the major problem(s) the company is going through, how management is attempting to rectify the problem(s), other important aspects of the investment situation, and a final conclusion characterized by a buy or avoid decision.

The investment opportunities Net Net Hunter's Investment Research Reports highlight are alone worth the cost of membership. It is very common to see any one of these stocks rise 50-100% within the course of a year.

Q: How many Investment Research Reports will I get each month?

A: I take Warren Buffett’s no called strike approach to net net stock investing. Ultimately, a good investment opportunity comes when it wants to, not when you want it to. That means that the number of Investment Research Reports each month will depend largely on the number of high quality opportunities I spot each month. My aim with Net Net Hunter is to communicate high quality opportunities rather than a mountain of mediocre opportunities. A higher number of mediocre stocks will not help you achieve the best possible investment returns — but that’s the exact approach that most other investment sites take! Get Access!

Q: How often are your stock screens updated?

A: The stock screens are updated at the end of each month. Again, our aim is to provide members with high quality investment opportunities which ultimately means depth of coverage rather than breadth of coverage. Lists that are updated bimonthly or even daily add little value, while communicating the quality of each opportunity in more depth is very valuable.

Q: What metrics are found on your stock lists?

A: We use a range of criteria when putting together our stock lists.

Raw Screens: Ticker Symbol, Name, F Score, Z Score, NCAV/Price, Market Capitalization, Dividend Yield, Shareholder Yield, EBITDA Yield, PE Ratio, and Subsector Name.

Shortlists: Ticket Symbol, Name, Exchange, Market Capitalization, Price/NCAV Ratio, Price/Net Cash Ratio, Debt to Equity Ratio, Current Ratio, Burn Rate Quarter Over Quarter, Burn Rate Year Over Year, Link to Financial Statements.

Please note that these metrics are subject to change based on community request.

Q: Why do your metrics differ between the two screens?

The Shortlists are based on Net Net Hunter's NCAV Investment Scorecard. I’ve developed this checklist after extensive research which uncovered metrics associated with outperformance. Many of these metrics have to be calculated by hand so putting together the Net Net Hunter NCAV Stock Shortlists takes a considerable amount of work each month.

By contrast, the Raw Screens include not only basic metrics, but also metrics that community members have requested.

Q: Are net net stocks penny stocks?

A: No, but you have good reason to ask that question.

Penny stocks can be very risky depending on the type of investment strategy that you employ. A stock is not automatically more risky just because it’s priced below $1. Take Microsoft (NASDAQ: MSFT), for example. Microsoft currently trades at $46.49 USD. If the company split its stock 47:1, each share would be priced at $0.99 and meet the criteria for being a penny stock. It’s insane, however, to assume that Microsoft had become a far more risky investment just because it split its shares all the way down to less than $1.

Net net stocks can be priced either above or below $1 — but I consider that fact irrelevant to the investment strategy. What really matters is if the stock you’re buying 1) is not a bankruptcy candidate, 2) is backed by solid, stable, value, and 3) is priced well below that value to provide a large margin of safety.

Q: What countries or markets do you cover?

A: Net Net Hunter currently covers the USA, Canada, the UK, Australia, Hong Kong, Europe, Singapore and Japan. This is subject to change based on member requests or market developments. Get Access!

Q: Will you increase your coverage to include other countries?

A: Almost certainly yes. Requests have been made for Singapore and specific countries in Europe, as well as India. I currently have no plans to extend our coverage to India due to the difficulty of finding trustworthy financial information on smaller Indian companies. The same goes for Singapore. We’re most likely to extend our coverage to Europe next. Get Access!

Q: I don’t know how to invest in net net stocks but I’d like to learn from somebody. Can you help me?

A: Definitely. I’m currently helping a few of our members become confident net net stock investors. They’ve essentially started without any knowledge of the stock market or investing but have built a lot of knowledge in a short amount of time. No matter where you’re starting from, I can help you increase your skill as an investor. The only thing I ask from you is openness to my ideas and suggestions, as well as a solid work ethic to learn what you need to learn.

Q: Do you cover NNWC stocks? If not, why not?

A: We only cover NCAV stocks. While I’m well aware of NNWC stocks, I haven’t seen any evidence that NNWC stocks provide better returns than adequately discounted NCAV stocks. Because of that, I haven’t focused any time on NNWC stocks. Get Access!

Q: Do we get access to your personal portfolio?

A: My portfolio is not part of the membership content but I'm more than happy to talk about my current holdings on our deep value forum. Just ask! Get Access!

Q: How do I cancel my membership?

If you really don't want to make the best possible investmemt returns and retire wealthy, simply email [email protected] with both your user name & real name and you won't be billed again. Get Access!

Remember, New Members Through The Intelligent Investing Podcast Save $100 Per Year Plus Get 6 Bonus Value Investing Guides

NET NET HUNTER MEMBERSHIP

per month (charged annually, recurring)

- 40 of the Best Net Net Shortlisted Each Month

- Raw Screens With Nearly 1000 International Net Net Stocks

- Access to Our Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

per month (charged annually, recurring)

- 40 of the Best Net Net Shortlisted Each Month

- Raw Screens With Nearly 1000 International Net Net Stocks

- Access to Our Inner Circle Forum

- Resource Center Access With Key Writing On Net Nets

- 12 Research Reports On Choice Net Nets Per Year

- Shortlist, International Net Net, and International Discount Net Net Indices

- Access Expert Knowledge to Implement the Strategy

- Inner Circle Advice Emails

- 3 Value Investing Sage Stock Analyses Per Month

- 5 Bird's Eye View Investment Strategy Guides

- Perfect For Financial Professionals With Clients or Small Portfolios

- Portfolio Construction 101 Investment Guide (Not Available Elsewhere)

- We Do All Of Your Investing For You - Just Make The Trades

- 12 Book Or Investment Resource Reviews Per Year

Don't Wait – You Only Have One Life

Imagine how you would feel at the age of 60 knowing that you could have invested in Benjamin Graham's most profitable investment strategy, but didn't. Don't waste this opportunity. The amount of money that you'll inevitably make off of even just one of our stock ideas would be enough to pay for membership for years... and we've identified nearly 50 fantastic investment opportunities. Don't wait. Join Net Net Hunter right now.