My 9 Year Net Net Stock Performance

On February 7th, my portfolio completed its rotation around the sun. The event gives me a chance to see how I have performed and ask whether I want to make any adjustments to how I go about working with cigar butts.

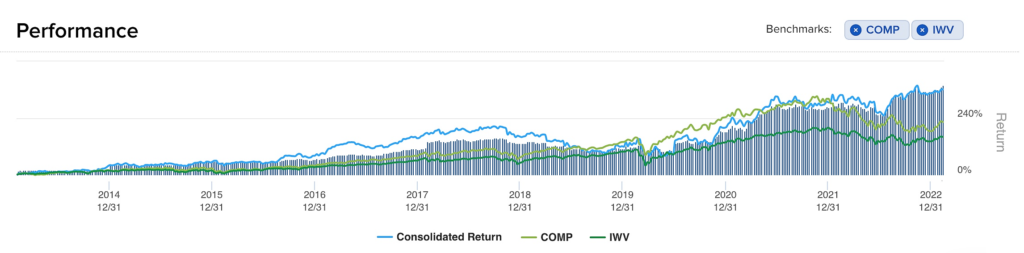

First, the performance…

Over the past year, my cigar butt portfolio produced a positive 10.9% return against the NASDAQ’s -14.7% loss. That makes for a difference of 25.6% for fiscal 2023. This past year, cigar butts and net nets specifically did what they were anticipated to do - hold up performance-wise during a mild downturn. This characteristic has major benefits for deep value practitioners because it keeps them from having to regain ground after a drawdown, thereby producing better long term performance.

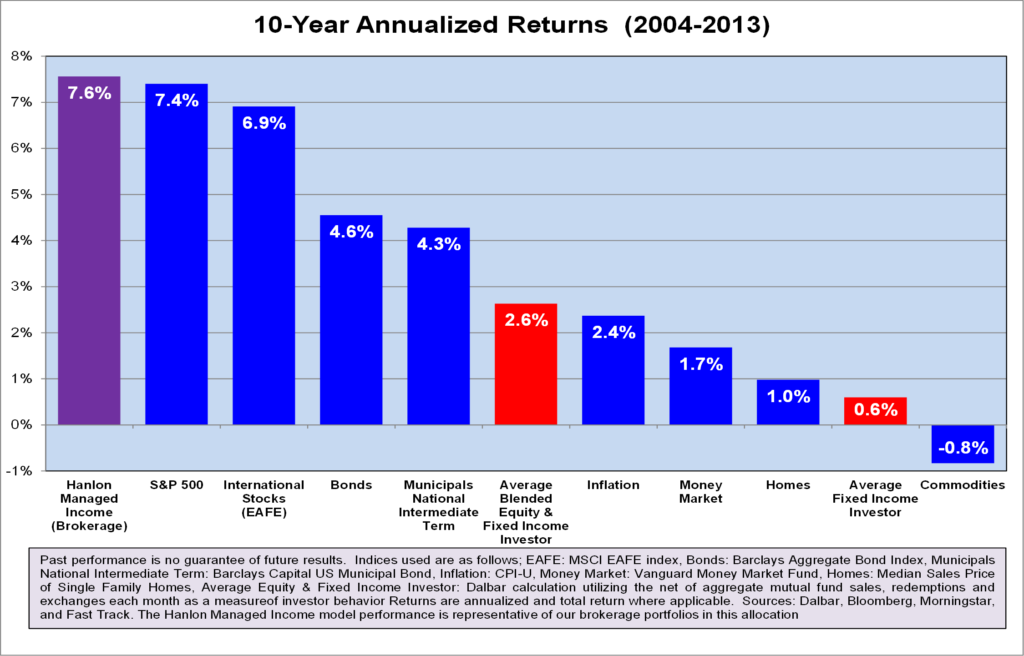

In terms of my own long term performance, over a 9 year period my portfolio achieved an 18.7% CAGR versus the NASDAQ’s 13.9% compound performance. This is below where I would like it, but, importantly, this time period spans what many considered “the death of value” from 2018 to 2020, when value strategies stopped working, and many actually produced losses. On rare occasions, growth - more accurately “momentum” - outperforms value, and value lags behind. This is especially true during bubble periods where a sector or industry sees massive capital inflows and other areas of the market become starved for cash, resulting in depressed stock prices. From 2018 to 2020, Big Tech sucked up an ocean of cash which pushed these issues to nosebleed valuations and left value unloved, with many strategies seeing negative returns each year.

This period came to a close in 2020, when value strategies started to produce positive returns again and better relative returns in 2022.

If you’ve been around for a while, you’ll notice that these events echo a period 20 years earlier - the Dotcom bubble - during which value lagged significantly and the word of the day was “internet.” What followed the Dotcom bubble collapse was one of the best periods for value returns in the last 50 years. In the early 2000s, the net net approach came out swinging with returns in the 25-50% per year range, helping to make up for the relatively mundane returns during the late 1990s.

Will we see a similar event take place as the Big Tech bubble continues to deflate? Quite possibly. What I am fairly clear on is that these periods where momentum dominates and value produces poor returns do not last long, and we seem to be at a point where investing for grownups is again coming to produce some great returns.

I’ve always said that there are a lot of ways to make money in the markets but not a lot of ways to keep it. The value approach does not provide the highest returns at times, but it is the best way to maintain the gains you have made. By contrast, it’s very easy to lose the high returns you have made if your buys are overvalued (or even fairly valued). As I’ve discussed elsewhere, when fast growth falls apart or the crowd loses love for a company, the security often drops like a meteorite, resulting in heavy losses. Last year’s YOLO millionaires are tomorrows McDonald’s counter staff or grocery clerks.

Story time!

When I was just a tiny rock flipper, still in diapers and wasting my evenings away in my crib, a couple of my dad’s coworkers won big after picking up a junior uranium miner. It was a tiny mining company that I guess they stumbled upon at the right time because soon after they bought, uranium went through one of its epic squeezes, rallying to some ungodly price. The junior miner, of course, took off like a bat out of hell, and it wasn’t long before the guys quit their jobs and were entertaining their former coworkers with lobster dinners and imported wine. Fast forward another couple of years, and the pair were back at work like nothing had happened, as the uranium price had collapsed under increased supply, pulling the stock price of their junior miner back down to Earth.

There are a lot of ways to make money in the market, but only a few ways to keep it. Obviously, it would have been better for the pair to have sold off their holdings progressively as the price rose, but this is an insight that comes with time & the pain of experience. Most retail buyers are not lucky enough to find a tiny depressed company that then explodes in price on some big macro theme. Most of the public buys high flyers already in the stratosphere, only to suffer large losses when the whole thing unravels.

But it doesn’t have to be this way for investors in-the-know. It’s possible for shrewd rock flippers to focus on picking up companies that are both depressed in price and have some massive event on the horizon that will likely lead to significant market action - like my dad’s lobster feasting coworkers. Great opportunities are indeed rare, but they are out there, and it is possible to identify likely winners before the race starts. Over the last couple of years I have slowly been warming up to this approach to cigar butt selection and have decided to adopt it as my own main selection strategy. No, I won’t be buying junior miners, but I will be looking for depressed issues selling at or below liquidation value where there is a clear and present catalyst and a likely miltibagger upside if it transpires. It’s not a foolproof approach, and a number of insights are sure to be erroneous, but if I pick up these little gems at or below liquidation value, losses should be minimal, and I should make something on each pick even when I’m wrong. We’ll see.

As you may have guessed, there is more to it than simply buying cheap with a catalyst, so I’ll have more to discuss on this on our Inner Circle Forum. I’ve already made a number of posts highlighting candidates that I find particularly attractive in this regard - tiny, stable, and cheap companies with very strong catalysts in play and very large upside potential if they work out. We’re bound to uncover more of them with just a little digging, so I’m really looking forward to what these next few years have in store.

Your 9 Year Returns... How Were They?

And more importantly, how much risk did you take on achieving those results?

Unlike NASDAQ investors, my returns were achieved buying beaten down stocks trading well under fair value. This means taking on far less risk than buying an index where more than 40% of the market price is made up of incredibly overpriced large tech stocks.

Net Net Hunter members, such as Clemens, have earned life-changing returns which have really transformed their lives.

"I am 55 years old and net nets freed me from my 9 to 5 job. I have a wonderful life now."

- Clemens, our most inspiring Net Net Hunter member

Yes, these people have learned how to apply the strategy but they've also developed the emotional temperament and fortitude required to earn great returns. They've mastered their emotions and have stuck to the strategy even when times were tough and things weren't working. These are rare traits among small private investors -- but they're absolutely critical when it comes to long term investing success.

Questions and Answers

A: I am not currently accepting clients but you may be interested in our sister site ValueInvestingSage.com which offers a high quality full service investment letter.