How To Invest In Cyclical Cigar Butts

One of the most profitable areas of cigar butt investing - and net net investing specifically - is investing in cyclicals trading below NCAV. Cyclical cigar butts give you the chance to invest in high growth companies but buying them for less than they can be liquidated for. This combo - high likely future growth at a cheap price - is rare in the market. Cyclicals are one of only a small number of places to find these sort of investments.

The returns on offer to cyclical net nets vary from poor to outstanding depending on which specific issues you buy and when you buy them in the cycle. You can even lose a lot of money if you buy at the wrong time in the cycle - so timing is very important.

The Anatomy of a Cyclical Industry

Some industries go through regular cycles that are fairly well known and can be reasonably predicted. These industries tend to repeat the same patterns of activity over and over again, from periods where the industry is starving for business and companies are really struggling, to periods where everyone is making a lot of money and the future looks unlimited. As the title implies, these good and bad periods cycle - neither the good nor the bad periods last. An intelligent investor who spends a bit of time studying an industry can pick his or her spot, pick up shares during an opportune time, and reap some fantastic returns.

So what is the basic anatomy of a cyclical industry?

Each has its own quirks and peculiarities, but there is a common pattern among them. Within each industry, as well, individual firms can buck the trend so the following outline should be treated as a general outline for what a cyclical industry looks like throughout the cycle. It all starts with Milk and Honey...

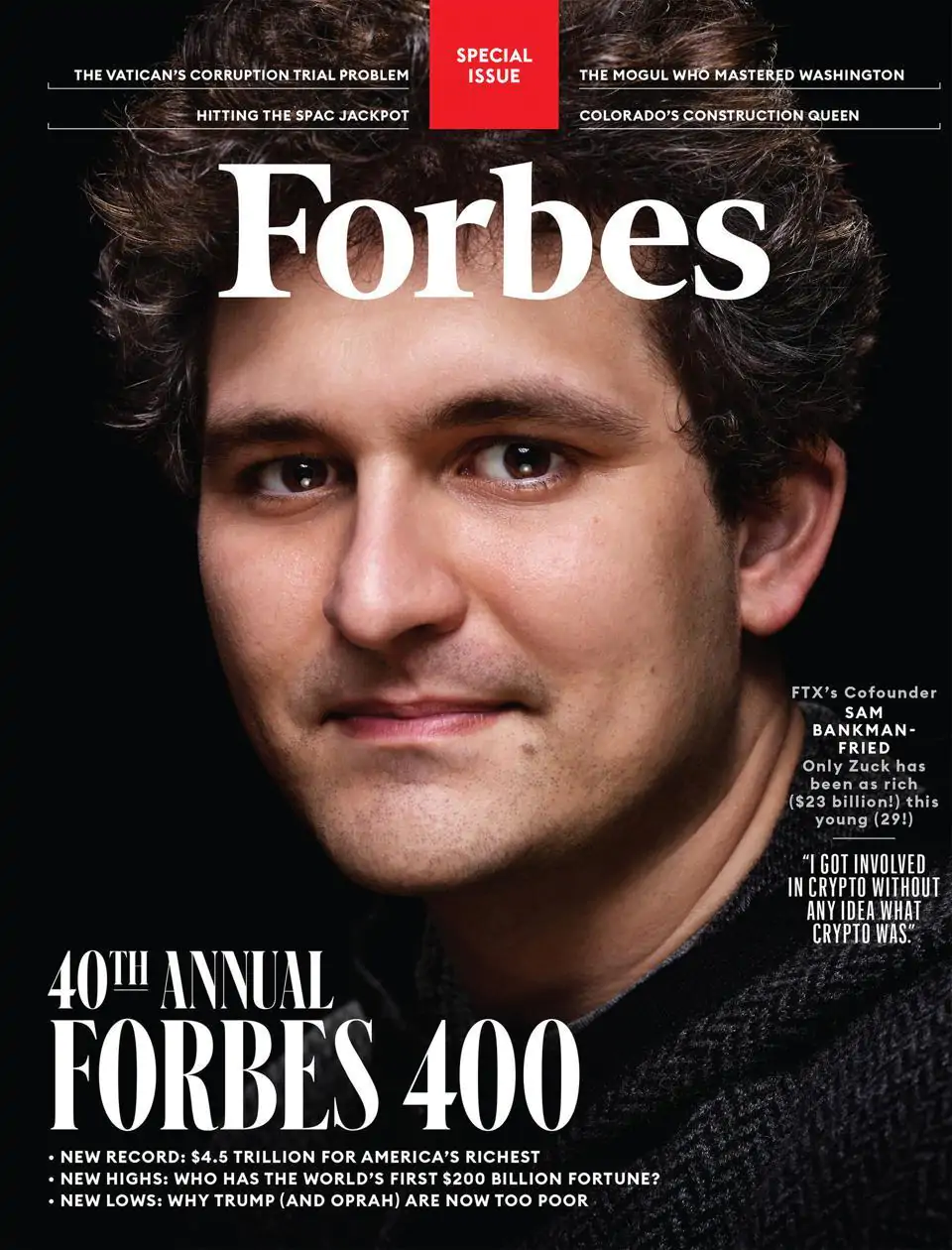

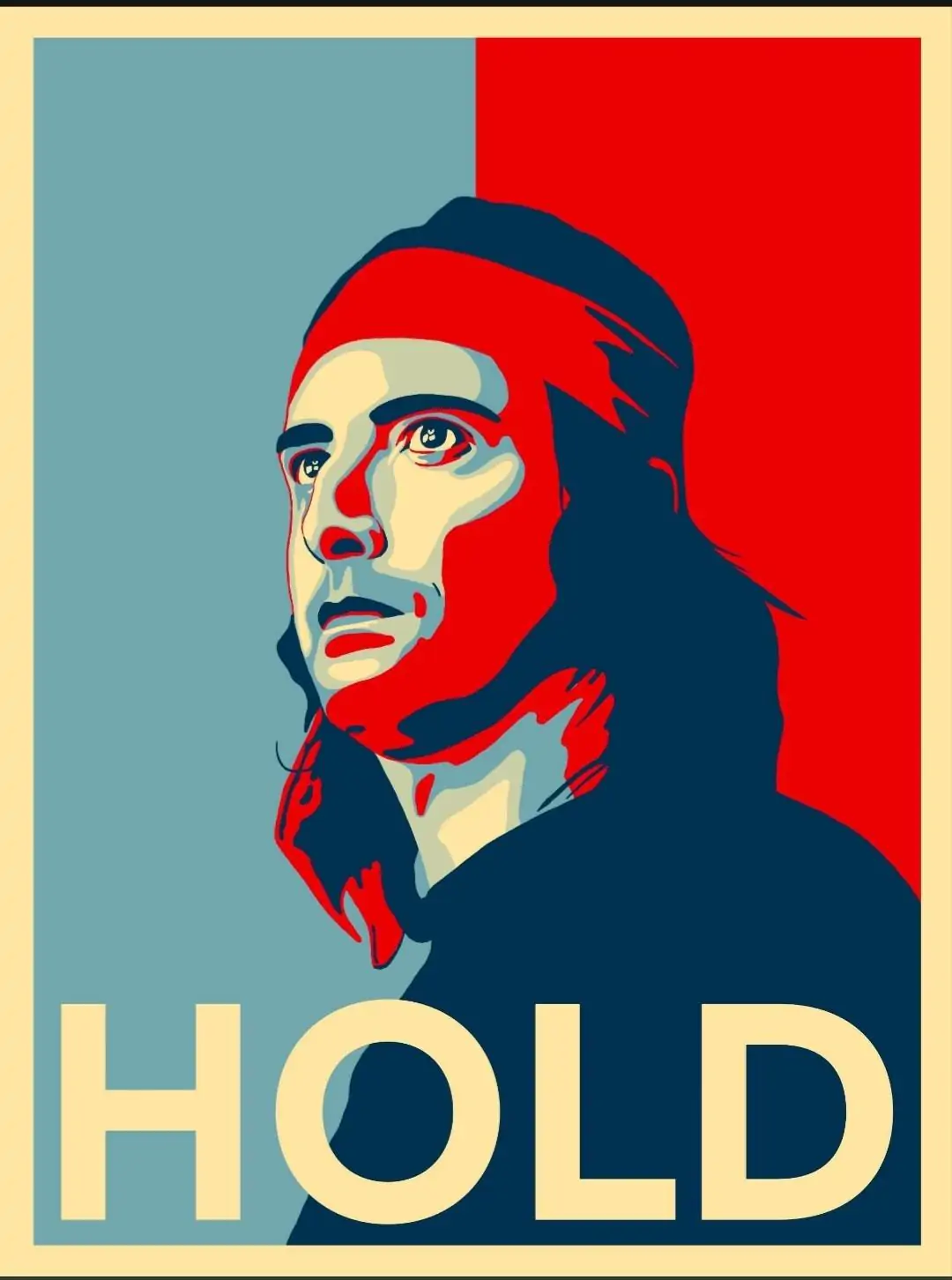

Milk & Honey (ie. The Bubble) - Firms are making huge profits and paying large dividends. Firms are expanding production, so more growth and profit is expected. Companies are making grand plans for expansion and CEOs are throwing fancy cocktail parties full of hookers & blow, imported elephants, Hollywood star appearances, etc, for politicians and bankers. Companies buy naming rights to stadiums, CEOs get featured on the cover of Forbes as the next Buffett, Gates, JP Morgan, etc. Investors are telling you to "Have fun staying poor!" Fraud is widespread throughout the industry. PEs tend to be reasonably priced (based on the general market multiples) - especially for the recent growth - but can get fairly high depending on how bubbly the market is. Firms are trading well above book value. The future looks "OBVIOUSLY" amazing, and many investors have these stocks packed into their portfolio. Your 10yr old niece and 80yr old granny are both asking you to recommend a couple of companies in the industry.

- Price to Book: Moderate to normal market level as investors feel increasingly confident in these firms

- PEs: Equal to the market or higher due to speculative enthusiasm

The Unraveling - Having expanded production, excess supply has hit the market, pushing profits down and causing firms to undershoot expected performance. Fraud starts to be uncovered. Firms drop rapidly, but multiples still look great, and investors can be looking at the recent drop as a blip, and BTFD.

- Price to Book: Companies generally price below book and could be priced well below book

- PEs: Very low, low, or moderate depending how recently things have begun falling apart

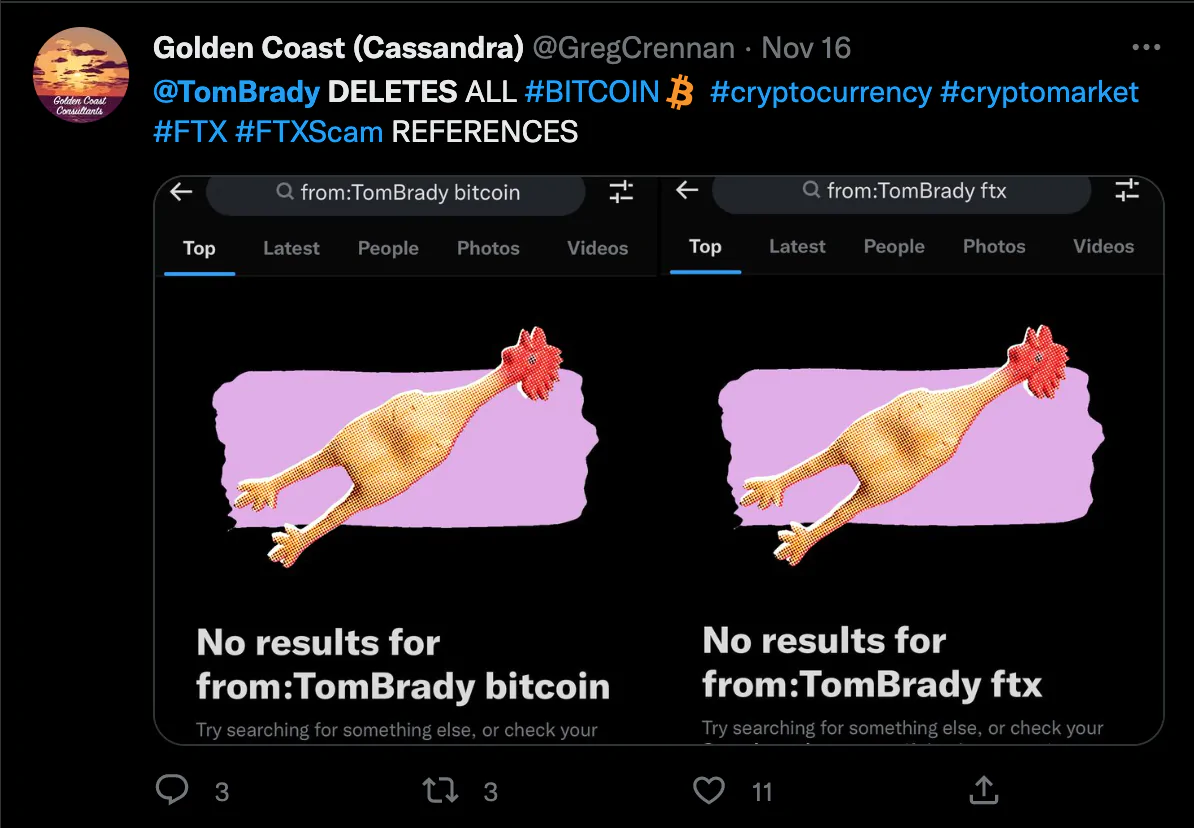

The Bust (ie. Bear Market) - Firms have been gutted in terms of profitability as the excess supply kept coming on line. Much of the new production can't be eliminated for whatever reason, so there is not much hope for industry wide profitability. CEOs are fired, frauds are exposed and people go to jail, politicians pretend they were never at the parties, celebrities pretend they never recommended the product, companies go through restructuring... Firms are trading well below book, and firms are quickly moving to losses if not there already.

- Price to Book: Very low to start but the discount is gradually eliminated as book value erodes

- PEs: Very high to negative as firms make token profits or losses

The Trough - This is as depressing as it gets for the industry. Firms are going bankrupt and there's questions as to whether the industry will exist at all going forward due to whatever reason. Debt to equity has increased and is nearly unmanageable for many firms. Bankruptcies, companies leaving the industry, skilled people leaving the industry, etc. Many firms have negative book value, but some can be trading at book or at a large discount to book depending on BS health. Almost nobody is making money so PEs are negative across the industry. When you mention the industry, investors laugh at you or tightly grip their wallet. Magazine covers declare the end of the industry. Some swear off the industry forever. For oil & gas producers, and oil field service companies, this was the year 2020.

- Price to Book: Generally high to negative, as book value has eroded significantly due to losses

- PEs: Negative across the industry, but can be very high for some firms due to token profits or other unique situations

The Recovery - Firms having gone bankrupt, liquidated, or having left the industry, etc, tightened up supply, so prices end up rising to the point where many firms are at least breaking even. Companies are moving from negative PEs to very high positive PEs as they shift from losses to token profits. Some bankruptcies can still take place, but fewer and they're less likely. All but the most shrewd investors are out of these stocks and probably not even paying attention to the industry anymore.

- Price to Book: Basically unchanged from the trough

- PEs: Very high to negative, but earnings are improving

The Bull Market - Tightened supply in the face of growing demand causes prices to rise and many firms shift from losses to profits. Some shift from small to large profits. Supply does not come on much because firms are cautious of a reversal and too busy paying back debt to invest more in production. The whole industry is doing better financially, and firms that survived are growing book value, profitability, strengthening their balance sheet, and beginning to pay good dividends or buy back stock. Prices to book can still be low for some more marginal firms but their PEs will be high due to just breaking even. More profitable businesses will be trading at or above book again, as well as reasonable PE ratios (ie. more in line with the market) and dividend yields. Dividend yields are falling because the yields are "safe" (but actually not at all safe). These firms are getting increasing air time on TV, space in mags, and investors are busy picking up stocks.

- Price to Book: Generally very high, then very low, then moderate as book value recovers and investor interest increases stock prices

- PEs: Go from very high or negative to very low, and then moderate as companies rapidly increase earnings, followed by investor demand pushing up stock prices

Back to Milk and Honey...

When Should You Buy Cyclical Cigar Butts?

The obvious time to buy is when the industry is in the dumps and the recovery about to start. Since this is a cycle, normal value rules don't 100% apply. A firm that is at book and barely profitable during a trough could be much cheaper than your average non cyclical company trading at a PE of 5x, growing 10% per year. This is because the amount of money that the company can be expected to make over the cycle can be much larger, and the fact that the cycle is recovering and boom years are ahead make the upside much more lucrative.

Value investors who are oblivious to industry cycles or who are buying based on multiples tend to avoid the trough in favour of the Bull Market or Milk and Honey. If they're buying during the Milk and Honey period, they can end up losing a lot of money (90% or more) while expecting the firms to advance meaningfully in price. "How can I lose?! The stock is sitting at a PE of 2x!" When you're applying multiples from any given year for valuation to a cyclical company, you're buying the illusion of value - not actual value.

A knowledgable businessman making an estimate of the fair value of a cyclical company will tend to assess the company based on its full cycle earnings, adding up each year and dividing it by the number of years to get an estimate. Bonus points for adjusting for inflation. Alternatively, buying below liquidation value during a period where that liquidation value is not expected to erode due to where the company is in the cycle is a good way to go. This would imply buying early into the cycle's recovery or the bull market.

The best time to buy is during the industry trough - because that is when the stocks are the cheapest. It also takes the most guts, though, and you never know if things are going to get worse. During these periods, buying the firm that is in the best financial shape while others are likely to go bankrupt is the safest move. The last firm standing will likely survive to see the next bull market, but you can still see significant temporary losses on your investment while profitability recovers.

Alternatively, buying during the recovery can be good because you can get clarity as to what's happening with the industry cycle (ie. that it's turning upwards) and prices are still very cheap if you are early enough. This is when I bought oil field services the first time.

The Bull Market can be an ok time to buy as well, as long as it's early in the bull market and you can still buy well below book. Here, things are obviously getting going for the industry, but few people have caught on, and prices are still cheap. I bought some more OFS companies here.

I would avoid joining a bull cycle that has progressed meaningfully, or where there are few cheap cigar butts left, as it is easy to confuse Milk and Honey for a healthy bull market, and get wrecked on the way down. It's like Buffett's ball room metaphor - everyone is busy dancing, ready to leave before 12 so they don't turn into pumpkins, but the clocks on the wall are missing their hands... Best to sell when things are going great than buy into low multiples while everyone is partying.

Importantly: different cyclical industries have different characteristics that drive their cycle, or indicate where they are in the cycle. The auto industry works on units pent up demand - there is some average number of cars that people should be buying during any given year, and if sales are badly under that number for years then a bull market right around the corner is more likely. Housing works off of demographics (home buying years), interest rates, etc. Container shipping (box ship freight) works off of the number of new builds in the pipeline that are going to hit the water. You have to understand the relevant metrics in an industry to get the best understanding of entry and exit points.

When to Sell a Cyclical Cigar Butt

The best time to sell is as the bull market progresses, or the industry experiences an inflection point that will turn the cycle south. For box shipping, when a mountain of orders for new ships have been made, that is a clear inflection point for the industry because eventually those ships will hit the water, significantly raising the supply of ships, pushing down rates, and starting a long drawn out bear market for the industry.

If you're more gutsy, you can wait to attend some of those parties and dive into the free blow before selling your shares. You'll make the most money then, but you're also dancing very close to the cliff edge.