How to Exploit Japanese Net Nets: The Twinbird Experience

I'll admit, my curiosity was immediately sparked when I first heard the term, "Japanese net nets."

The idea of investing in these mythically value stocks in a country as intriguing as Japan was very alluring, but I had serious reservations.

For one, would the devastating performance of the Japanese stock market only lead to large investment losses? Would the relative ignorance of Benjamin Graham prevent Japanese net nets from rebounding back up to full valuation like net nets do in the West?

And, probably most importantly, how would I deal with the Japanese language barrier?

It's been about 6 months since I began investing in Japanese net nets, and by now I've more or less tackled these issues. If you're as curious as I was about stepping into these stocks, let me give you a window into how I view this unique investment opportunity.

Why Japanese Net Nets?

It's no secret that NCAV stocks do fantastically well as a group -- a fact that the 1500+ value investors who requested the free net net stock checklist know well. Benjamin Graham himself wrote in the Intelligent Investor that a typical investor can expect returns at least around 20% per year over the long run. The studies that I've read have all shown returns well above that figure, however, with some ranging all the way up to the high 30s -- and my own portfolio has blasted past the market over these past 4 years at around 30% per year.

Net net stock investing is both simple and profitable, so long as you have the temperament required to buy into deeply depressed situations.

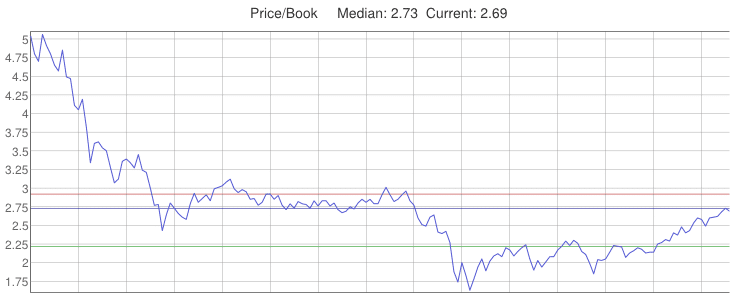

But the general unavailability of net net stocks during market peaks is also well known. In fact, if you're just investing in the USA, you can count on net net stocks opportunities almost totally drying up at the upper reaches of a bull market. Past a "normal" market PE, using the strategy becomes problematic. There just aren't enough issues to put together a well diversified portfolio, or enough higher quality net net stock opportunities that would justify a more concentrated portfolio. In fact, most of the US net nets available at the time of writing this in September 2014 are either totally illiquid, Chinese reverse takeover scams, or have other major barriers that prevent purchase.

When you decide to employ Ben Graham's famous strategy, it becomes very clear very quickly that you have to branch out internationally in order to fill your portfolio. Hence Japanese net nets.

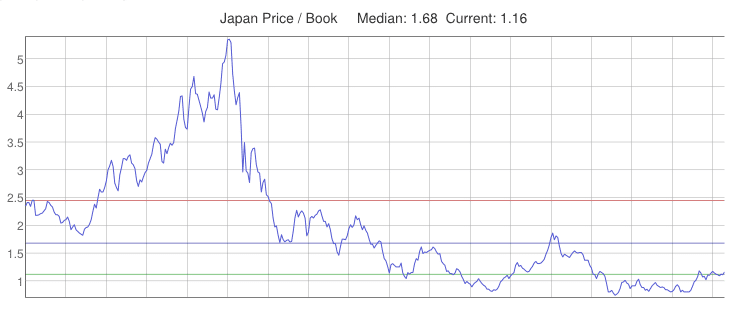

When it comes to deep value opportunities, no other market offers the type of opportunities that Japan does. Japan's financial markets are enormous. When you combine their size to the depths that they've sunk to over the last 30 years, you end up with a market that provides a massive number of good quality NCAV stocks.

Right now on our Net Net Hunter Stock Shortlists, we've narrowed down roughly 200 Japanese net nets to highlight the 12 best opportunities available. Those twelve make up 31% of the stocks on our Net Net Hunter Investment Shortlists (out of 39 shortlisted stocks, total), and are generally of much better quality.

Did Ben Graham Travel Overseas?

According to a couple of our Japanese members, Benjamin Graham is not widely known in Japan. He's just not popular.

With that type of disinterest, one of my big concerns about investing in Japanese net nets was that -- maybe -- value stocks in Japan would underperform, or at least would not have the same kind of performance as value stocks in the West. In the West, there are a lot of investors hunting for bargains. When bargains are found, investors tend to bid prices up, eliminating most of the investment's margin of safety in the process.

Absent that general mindset, would Japanese net nets just kind of float motionless at the bottom of the market? Or, at least, would it take so long for Japanese net nets to get noticed and bid up in price as to negate any advantage that net net stocks have to offer?

No.

A recent paper by James Montier has shown that Japanese net nets do work out very well. Just like their western counterparts, Japanese net nets decimated the Japanese indexes from 1985 to 2007 by 15% per year! That's 15% ABOVE the index's 5% return on average over that time period -- for a meaty 20% CAGR.

To put that into context, over the same time period American net net stocks beat the index by 18% per year. Obviously any concern about Japanese net nets not working out due to disinterest was misguided. Japanese net nets compare very well to net net stocks in the West.

For a great introduction to investing in Japan, click here.

Breaking the Language Barrier

Another concern was my total inability to work in the Japanese language. Since most firms in Japan publish Japanese language results only, a lot of the typical information that value investors use to identify a potential investment is just not available.

Before you buy a typical value stock, you comb through the 10Ks and proxy material with a laser guided magnifying glass in order to uncover those tiny details that might give your portfolio an edge. It takes a lot of reading and digging to find an opportunity.

By contrast, investing in NCAV stocks is all about playing probabilities. It's a sort of contrarian strategy. Since the population of net net stocks work out very well, you should be able to just buy a large diversified group of them to approximate the returns of the population. Over your holding period, some of your stocks would work out and some would suffer losses, but the overall result would be very good.

To give yourself an edge, you could look for characteristics that have been associated with outperformance: the lowest possible price relative to NCAV, buying firms without debt, looking for insider buys, etc. Essentially, this is the strategy that I've taken with our Net Net Hunter Investment Scorecard. When it comes to how I invest in net nets, reading the annual reports is important, but mostly to double check the balance sheet figures and to identify qualitative elements on our Net Net Hunter Investment Scorecard that will help give my portfolio an edge.

But, you wouldn't need to comb through the annuals to uncover a lot of the desired information. Consolidated English financials for Japanese stocks are available online, and you can easily spot favourable Debt to Equity Ratios or share buybacks using a firm's financial statements, for example. News releases can be translated through Google services, and English translations of press releases are published online by 3rd parties.

In short, you can get enough of a picture using the available information to tell whether ant particular stock is likely to be a better than average buy.

Another reason that the lack of English language financial reports isn't as big of an issue as you might think is because of the way that net net stocks tend to work out. A lot of the returns provided by NCAV stocks are event driven. That means that the slimy, good for nothing company that you pick up could be tumbling along trying to sort out its problems when all of a sudden a bit of good news comes out, or another firm decides to take over the company, and overnight the share price spikes allowing you to cash out at a massive gain. These sort of events happen to roughly half of the net net stocks I buy, but just can't be predicted in advance.

While I don't shy away from them, when buying Japanese net nets I like to keep each position a small part of my portfolio given the lack of information. I just feel its prudent to spread more money among more positions when not having as clear of a picture of the investment opportunity as I would like. And, if you absolutely must have in depth annuals to examine, you could always get them translated by a professional translator.

Japanese Net Nets: My Twinbird Experience

Back in April of this year I decided to plunk down a chunk of money on a Japanese home electronics manufacturer named Twinbird.

Twinbird is a company that builds things like fans, toasters for your home, and space-aged coolers that you can take on your camping trip. What caught my eye was the company's former level of profitability, it's price relative to its past four years of earnings, and it's sizeable NCAV growth rate.

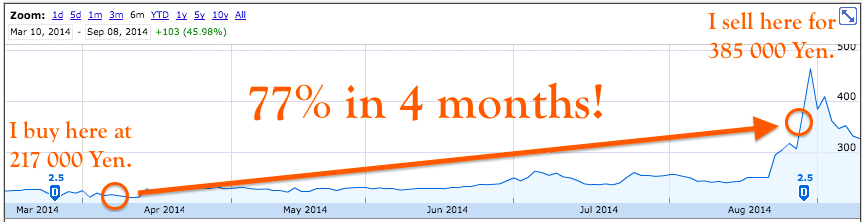

The company had suffered a massive 81% drop in earnings in 2013, causing the share price to tumble. When I picked up my stake in April at 217 000 Yen per share, the stock price had fallen 59% below it's 2011 high of 530 000 Yen. While I didn't know what exactly was going on, the company cited weaker overall demand for its products. This story fit the mould of a great net net stock opportunity, perfectly.

Despite taking a massive hit to earnings, the company was still profitable and growing its NCAV at roughly 10-15% per year. With its current crisis underway, the firm's PE ratio had sunk to almost 7x its TTM earnings, or under 5x its 4 year average earnings figure. It also had relatively little interest bearing debt, at just about 25% of equity, and a Current Ratio above 3x. In short, it had a strong balance sheet.

I'm agnostic about what will ultimately happen to any one of my holdings. I like to select financially sound companies to avoid devastating bankruptcies, such as the one that Ablemarle & Bond Holdings stumbled into. I also try to set things up so probabilities are overwhelmingly stacked in my favour. Beyond that, though, I don't really know what will happen to any one of my picks. That's fine with me -- the majority of net net stocks work out and I'm selecting the most promising ones based on additional qualitative and quantitative factors.

5 months later, Twinbird had begun to worry me. The pattern of gains the company had made in terms of NCAV had slipped into a small loss, and the firm had picked up a bit of fat around the midsection in terms of interest bearing debt. Twinbird's financial strength had begun to weaken, despite the 15% gain the stock had recorded since I picked it up. My plan was to recheck the story over the next couple of quarters to see if things would turn around or if I would sell due to a darkening picture.

Then August hit and for some reason the price spiked 18%. I checked Google Finance and the company's Japanese language news releases, but there was nothing in the way of news. I turned to Google and conducted searches into the company, the Japanese economy, or anything else I could think of. Still nothing.

The stock blipped up another 8% by the closing bell the following Monday. I knew something had happened, but I wasn't sure what. Later that week the stock rocketed up 25%, just below my assessment of the firm's NCAV. A day later, the firm's stock price blew right past its NCAV, and I was able to cash out at a massive 77% gain in roughly 4 months. That's an annualized return of 308%!

Now do you see why I love net net stocks so much?

As one of our Japanese members pointed out a while later, some Japanese financial magazine listed Twinbird as a must own stock for the second half of 2014. The shift in sentiment threw the stock so violently upwards that trading actually had to be halted two days in a row.

While it might seem like a unique one time event, this kind of scenario is actually fairly common among net net stocks. While being listed in a widely read Japanese investment magazine might not exactly be common, these stocks often shoot skywards on a bit of good news, which accounts for a large chunk of the returns forked over to NCAV stock investors. As it turns out, Japanese net nets are no different.

Currency Wars

"But," you might be thinking, "what about the risk of inflation in Japan? If I invest in Japanese net nets, won't I lose out if the currency is devalued?"

There's been a lot of talk about the risk posed to the Yen due to the policies of Japanese Prime Minister Abe. The macro risks have been voiced pretty loudly in the investment community for some time now.

I don't have a position as to what will happen to the Yen. I'm pretty agnostic about it. Part of that stems from the fact that macro events are outside of my circle of competence. Another, perhaps more significant, reason is that market pundits have a very bad record when it comes to predicting market events. As former chairman Alan Greenspan once said, economic forecasting is better than a flip of a coin, but not by much.

Contrast that with the high probability of fantastic returns that net net stocks offer -- not to mention Japanese net nets. Given the fact that NCAV stocks have a high probability of working out very well, does it make sense to base your investment strategy on something far less certain?

Whether significant inflation and a further devaluation of the Yen occurs is yet to be seen. The Japanese PM is aiming for a 3% inflation rate, which is on par with what western economies consider normal inflation. If they're able to hit that figure, there's nothing much to worry about.

But what if rapid inflation does hit? Wouldn't your portfolio take a major hit?

That's not so certain, either.

Stocks, according to studies highlighted by David Dreman, also keep up with inflation over the long run. If you continue to invest in Japan over a number of years, you can pretty much count on stocks keeping pace with inflation over time. That should be a comforting thought for a lot of long term NCAV stock investors.

By the way, how is the American dollar, British Pound, or Euro expected to do going forward?

Japanese Net Nets For the Win!

In the end, given the probabilities of success, investing in Japan is a great way to fill your portfolio full of high performance net net stocks.

The language barrier and cultural differences do not pose a significant roadblock to investors competent enough to read a set of financial statements. While you don't have the same ocean of information available for western net net stocks, there is still enough there to get a good idea of whether a stock is worth picking up or not. A large chunk of the returns available from NCAV stocks are driven by unpredictable events, anyways, and investors can diversify into a number of Japanese net nets to help spread any additional risk. Doing so would still yield great returns, seeing as net net stocks as a group are fantastic investments, anyways.

Not quite sure how to get started? Join over 2000 other value investors by requesting a free net net stock essential guide. Enter your email address in the box below right now.